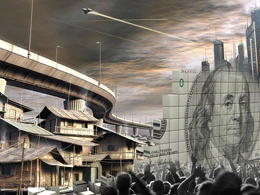

Crypto is the next step toward a cashless society

It will take some time for consumers to warm up to crypto, but education is the key to its mass adoption. From QR code payments to mobile banking apps, consumers worldwide are increasingly reliant on digital payment solutions, especially as mobile technology becomes more ubiquitous. Government-led efforts in driving cashless economies have been a key factor, with countries such as Singapore or the Philippines seeing their central banks driving the adoption of contactless payments during the height of the COVID-19 pandemic. As a result, usage rates for digital payments platforms have....

Related News

Every day one hears about the impending demise of physical cash - the dirty coins and banknotes that our grandfathers used for everyday transactions, and some filthy criminals still use today - and the upcoming transition to a cashless society. To us geeks that seems initially a good idea - more virtual, more wired, more connected, more cyber - but then one has second thoughts. Cashless society? I say NO, thanks. Not yet. Sweden Leads in Cashless Transactions. Cashless as they intend it means 24/7 surveillance. It's a tool of Big Brother. If you have doubts, let me lay them to rest for....

As Denmark and Sweden spearhead the move to a cashless society, the ramifications of such a transition for humanity as a whole could result in the exclusion of certain groups and classes. A cashless society is one where people do not use physical cash; all purchases are made by credit cards, charge cards, checks or direct transfer from one account to....

Secondly, putting banks in full control of our society's money is the last thing anyone should want. Banks already hold a lot of control over our funds, and they are the very reason why the recent financial crisis took place to begin with. With all of the recent talk about a cashless society, the question inevitably turns to the role of Bitcoin and other digital currencies. Some people would like to see more anonymity in Bitcoin, especially when considering how going cashless would give banks and governments a complete overview of how consumers spend their funds. Although some people might....

Cryptocurrency may emerge as a more widely adopted means of exchange as consumers grow increasingly comfortable with cashless transactions. The recent health scare surrounding the COVID-19 outbreak seems to have accelerated the move toward a cashless society, with cashless payment spiking in concert with viral cases.Yet, our findings in a Genesis Mining study called “Perceptions and Understanding of Money 2020” indicate that a significant majority of Americans are not psyched about parting with their paper money on a permanent basis.To be more specific, we found that 60% of respondents are....

A leading financial association in Norway recently suggested that the country could very well be on track to becoming cashless by the year 2020. The group noted that only about five percent of transactions conducted in the country are done so with cash, and suggests that eliminating paper money would likely pose no harmful effects to the economy. "Cash now represents such a small proportion of payments in the society, that we could well do without it," a statement read on the Finans Norge website earlier this week. The organization represents 200 financial institutions that are currently....