Bitcoin Support Thins Below $78,000 As Cost Basis Clusters Shift Toward $95,000

Bitcoin’s price action in the past 48 hours has seen it approaching the $80,000 price level again, with risks of breaking to the downside. Looking at on-chain data shows a notable support level between $80,920 and $78,000 that must not be broken. Related Reading: Pi Coin Sinks 47% In 14 Days—What’s Behind The Massive Drop? Particularly, on-chain analytics from Glassnode point to a thinning of support at the $78,000 level, where only minimal cost basis clusters now exist. The insight follows a sharp move that saw savvy traders scoop up nearly 15,000 Bitcoin at the March 10 low before....

Related News

Whale clusters show that the key-short term support areas for Bitcoin are $16,694, $16,411 and $16,064. Since topping out at $19,484, Bitcoin price has struggled to reclaim the $17,000–$18,000 level. As the price continues to decline, traders are targeting key underlying support levels to determine where traders will buy if Bitcoin (BTC) price continues to fall. The immediate support levels based on whale clusters are $16,694, $16,411 and $16,064. Below the $16,000 support, $15,355, $14,914 and $13,740 could serve as macro support areas.Whale clusters form when whales accumulate BTC and do....

A cryptocurrency analyst has revealed where the most significant Dogecoin support level is located, according to on-chain cost basis data. Dogecoin CBD Points To $0.08 As Strongest Support In a new post on X, analyst Ali Martinez has talked about how Dogecoin support is looking from the perspective of the Cost Basis Distribution (CBD). The CBD is an indicator created by on-chain analytics firm Glassnode that tells us about the amount of DOGE supply that was last purchased or transacted at the various price levels that the coin has visited in its history. Generally, investors are sensitive....

New data from Whalemap reveals three whale clusters around $12K that should act as support and resistance areas for Bitcoin price in the short term. According to Whalemap, there are three major Bitcoin (BTC) whale clusters in the near term that might serve as key technical levels. The $11,857, $12,256 and $12,868 levels would likely act as important support and resistance areas.In previous cycles, whale activity coincided with significant price movements at crucial technical levels. For instance, Cointelegraph reported that a whale sold at $12,000 after “HODLing” for years. In the next few....

Bitcoin whale clusters show that the $18,600 level is the most important short-term resistance level for BTC price. The price of Bitcoin (BTC) has started to recover on Dec. 12 after briefly dropping below $17,700 yesterday. Whale clusters show that the $18,600 level remains the biggest short-term roadblock for BTC.Whale clusters form at a price point where whales accumulate Bitcoin and do not move their holdings. Since whales are more likely to sell at a profit or breakeven rather a loss, clusters typically act as support or resistance levels.In the near term, whale clusters from Whalemap....

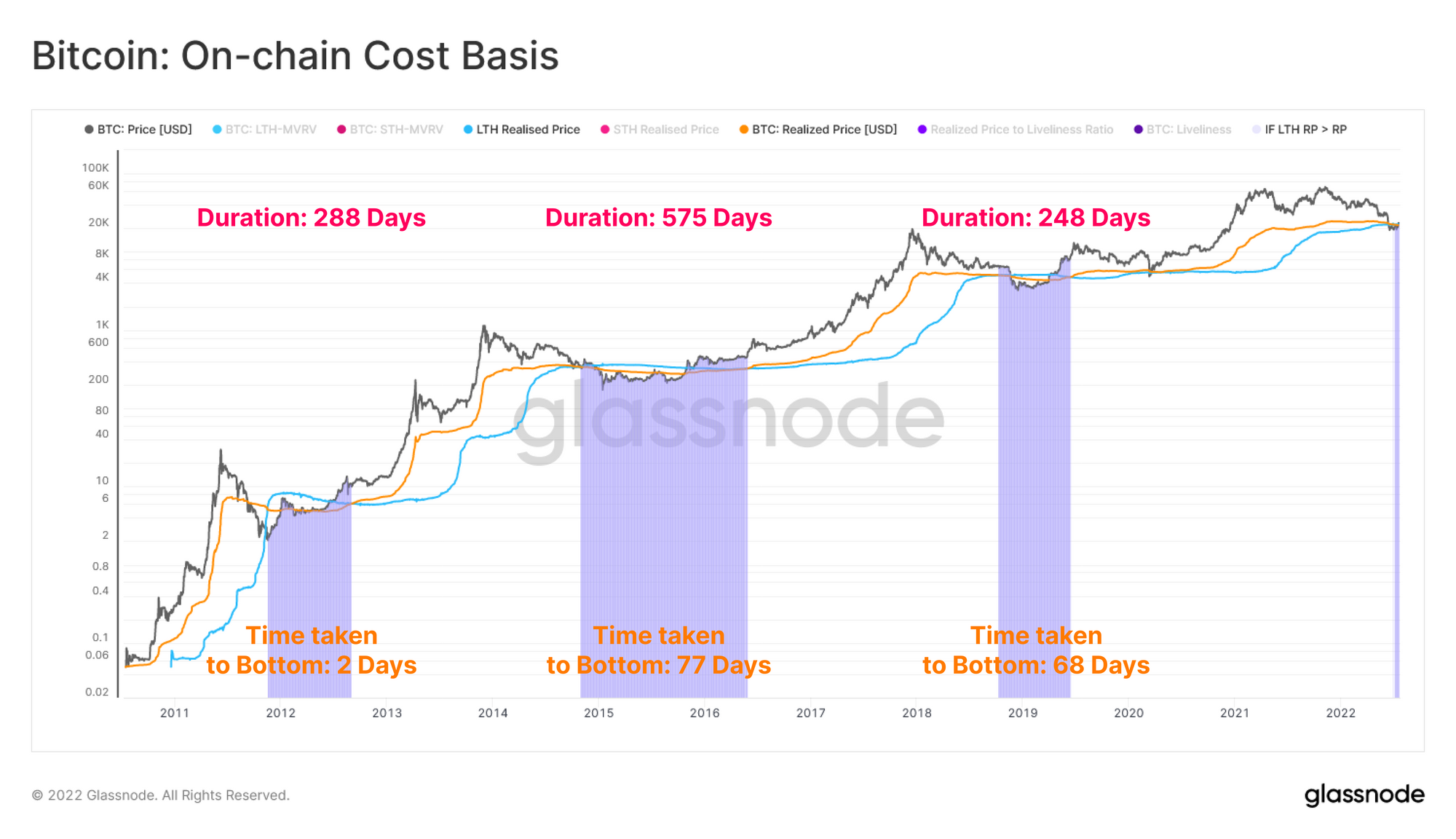

Data from Glassnode shows the Bitcoin long-term holder cost basis is currently above the realized price of the crypto. Bitcoin Long-Term Holder Cost Basis May Have Hints For Bear Market Length As per the latest weekly report from the analytics firm Glassnode, the LTH cost basis has remained below the realized price for a period […]