Kentucky Bill Seeks to Lure Crypto Miners With Tax Breaks

Reps. Rudy and Freeland's bill would exempt crypto miners from paying either Kentucky sales or excise tax.

Related News

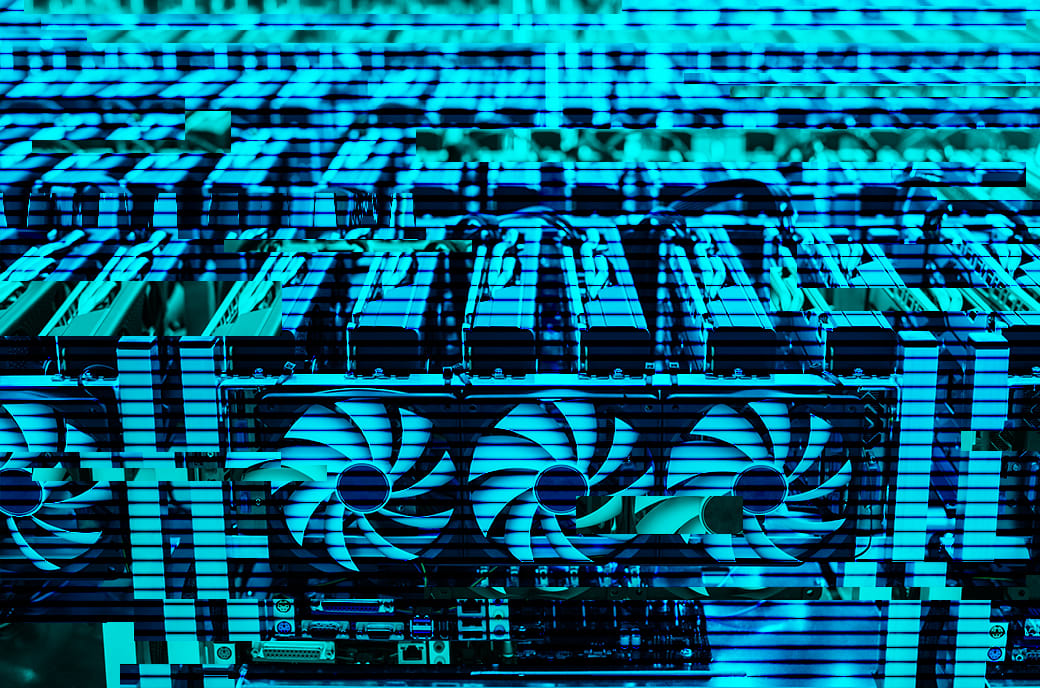

The Kentucky House Budget Committee approved a bill in a 19-2 vote to eliminate the sales tax on electricity for use in cryptocurrency mining operations. The bill, designed to attract more miners to the state, is now in the Kentucky Senate for review. Lawmakers Urge Greater Crypto Appeal Despite Purported Costs Motivated by the explosive growth in blockchain technology and the increased spotlight at cryptocurrencies, Kentucky lawmakers are busy crafting legislation designed to appeal to mining operations. House Bill 230, which the House Budget Committee approved on Tuesday, is designed to....

Kentucky needs to attract more crypto mining businesses by offering tax breaks, local lawmakers believe. Lawmakers in Kentucky are looking to impose tax breaks for local cryptocurrency miners.Kentucky lawmakers on Tuesday approved several state tax breaks including House Bill 230, which would remove the sales tax from electricity purchased by local crypto mining operators.According to a report by the Lexington Herald-Leader, Kentucky legislators voted 19 to two for the new measure. The bill’s fiscal note is reportedly estimated to cost the local budget at least $1 million annually. The....

Kentucky legislators have approved a bill that would offer tax incentives to bitcoin miners that set up shop in the state.

A new law in Kentucky will provide tax exemptions to cryptocurrency mining operations and attract them to the state.

Bitcoin (BTC) frenzy is sweeping across the US following Donald Trump’s victory in the November presidential election, with Kentucky becoming the latest state to introduce legislation aimed at establishing a Bitcoin reserve. Kentucky Joins The Bitcoin Reserve Club Kentucky has become the 16th US state to introduce legislation seeking to create a Bitcoin reserve. Introduced […]