November Crypto Market Turbulance Shakes Holders To Their Core

With an average 6% loss and a 10% correction in the weekly chart for Bitcoin, Cardano (ADA), XRP, and others, the crypto market has been trading in choppy waters for the past days. The uncertainty has brought a change in the sentiment, as traders prepare for further downside. Data from Arcane Research records a flipped in the Fear and Greed Index, the indicator has quickly moved from “Greed” to “Fear” as Bitcoin and other major cryptocurrencies in the top 10 by market cap retested critical support levels. Bitcoin had a particularly bad week in terms of performance as an increase in....

Related News

During the past eight months, crypto assets have shed enormous value against fiat currencies like the U.S. dollar. Bitcoin has shed 69% since the leading crypto asset’s all-time high on November 10, 2021, when the digital currency’s value tapped $69K per unit. The crypto economy has seen some healing as the market capitalization of all 13,413 tokens in existence is hovering just below the $1 trillion mark.

Today’s Top 10 Crypto Assets Have Lost 70 to 90% in USD Value

At the time of writing the entire crypto-economy is worth $983.65 billion after it lost more....

A recent Glassnode report says some long-term holders (LTHs) of bitcoin offloaded part of their holdings and cashed out their profits during a bull-run. Still, the report explains that the sell-off, which has been noticeable since late November, is not necessarily a sign of an approaching bear market. Instead, as the data shows, BTC is poised for another rally. Since Nov. 26, when the price of BTC dropped by more than 17% in 24 hours, the digital asset has recovered and currently trades above $19,000. Some analysts believe that it is only a matter of time before the leading crypto....

Stranded natural gas operations could be the next major avenue of Bitcoin’s entry into the global energy production industry. The post How Bitcoin Shakes The Energy Industry appeared first on Bitcoin Magazine.

Data reveals that mostly mid-to-long term holders were selling their Bitcoin during November, thus being responsible for the correction. Bitcoin UTXO Age Shows Mid-Term Holders Sold Their Coins In November As per the latest weekly report from Arcane Research, mid-term holders seem to be behind the decline in BTC’s price during the month of November. The relevant on-chain indicator here is the “UTXO Age.” UTXO stands for Unspent Transaction Output; you can think of it as a Bitcoin mechanic that keeps track of coins on the chain. The UTXO age metric measures how long it has....

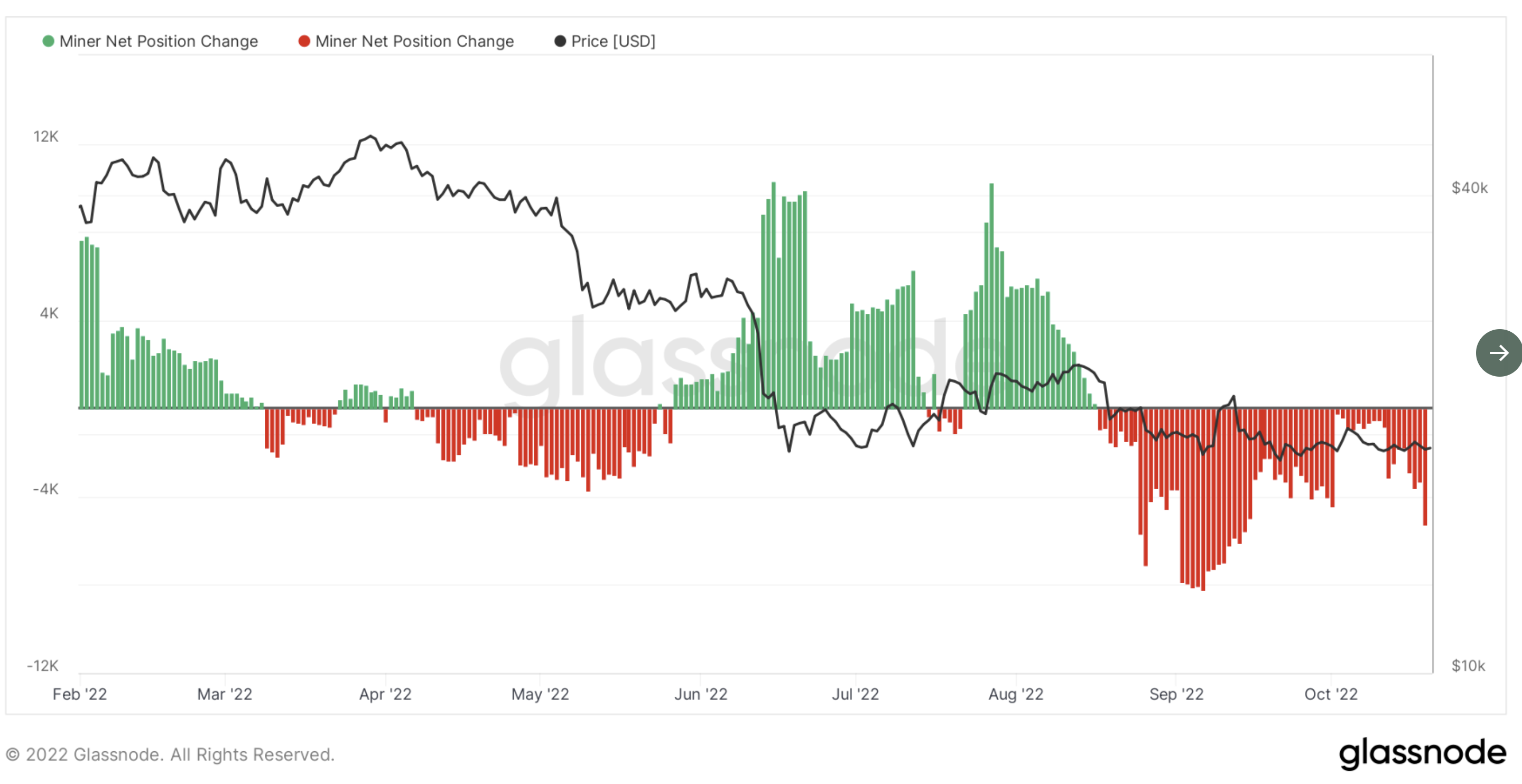

The largest publicly traded Bitcoin miner in the U.S. by hash rate and mining fleet, Core Scientific (CORZ), issued a bankruptcy warning in a filing with the SEC on Oct. 26. Shortly thereafter, the stock took a nosedive. The stock plummeted from $1.02 to $0.22. While the CORZ stock was trading at $10.43 at the beginning of the year, it is now down 97% year-to-date. Notably, the Bitcoin price was unimpressed by the news. As NewsBTC reported, a Bitcoin miner capitulation is currently the biggest intra-market risk. Therefore, it is questionable whether the risk of a capitulation event is now....