Grayscale rebalances DeFi Fund dropping Balancer (BAL) and UMA

Major digital asset manager Grayscale has rebalanced the DeFi Fund for the second time since its inception in July 2021. Crypto asset manager Grayscale Investments has rebalanced its Grayscale DeFi Fund and adjusted weightings of its Digital Large Cap Fund.A Jan. 3 announcement detailed the changes Grayscale made to its two funds. The DeFi Fund’s weightings have been rebalanced with AMP, the native collateral token of the Flexa payment network being added, while Bancor’s (BNT) and Universal Market Access (UMA) have been removed. Flexa uses the AMP token to collateralize crypto payments and....

Related News

Digital asset manager Grayscale has launched a new DeFi fund with CoinDesk Indexes, according to a press release. The Grayscale Decentralized Finance (DeFi) Fund will offer its clients exposure to some of the major tokens in the sector. The fund will track the CoinDesk DeFi Index, created on May 10, 2021, to “measure the investable […]

Michael Sonnenshein, the CEO of digital asset management giant Grayscale, has announced a new investment vehicle aimed at decentralized financial assets (DeFi). Grayscale Eyes DeFi Grayscale, the world’s largest crypto asset manager, is expanding its crypto product offering with the launch of its new Defi Fund, which is the firm’s first of its kind. The […]

Grayscale Investments has launched a decentralized finance (defi) fund. The new defi fund is the crypto asset manager’s 15th investment product and its second diversified product. “The emergence of decentralized finance protocols provide clear examples of technologies that can redefine the future of the financial services industry,” said the Grayscale CEO. Grayscale Debuts Decentralized Finance Fund Grayscale Investments, the world’s largest digital currency asset manager, announced Monday the launch of its newest diversified investment product, the Grayscale....

The Grayscale Investment manager undertakes another phase of balancing its Grayscale DeFi fund. This round of rebalance inculcate the adjustment of the project’s Digital Large Cap Funds. This move marks its second balancing process after its launch in July 2021. An announcement on January 3 revealed the in-depth adjustments to Grayscale’s two funds. The first rebalancing employed the Flexa payment network’s native collateral coin. Related Reading | Could Kazakhstan Turmoil Cause Another Bitcoin Hash Crash? Hence, Grayscale DeFi Fund’s weighting was rebalanced....

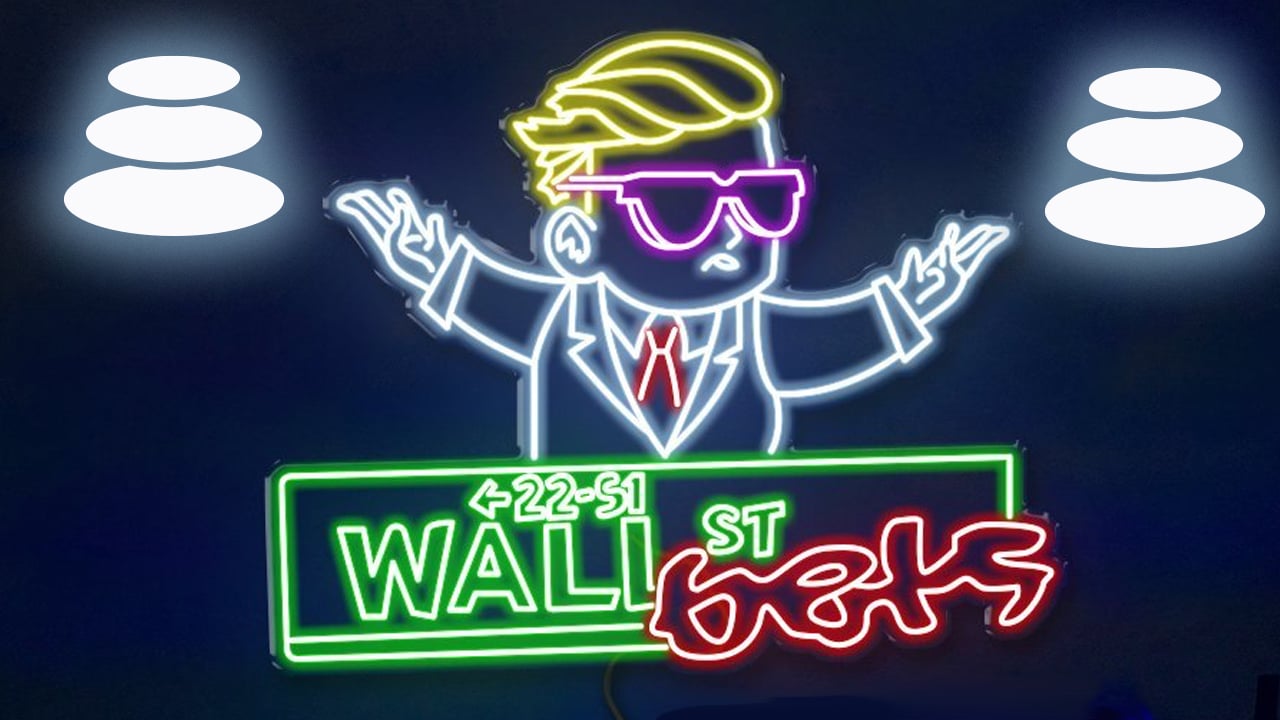

On Wednesday, the programmable liquidity platform Balancer Protocol announced the project has partnered with the Wallstreetbets defi project Wsbdapp. The announcement details that the two projects will collaborate in order to launch Wsbdapp’s exchange-traded portfolios (ETPs) on Balancer V2. Balancer Protocol and Wallstreetbets’ Defi Project Partner to Launch Exchange-Traded Portfolios Last week, Bitcoin.com News reported on the newly launched Wsbdapp decentralized finance (defi) platform hosted on the website wsbdapp.com. The application’s creators claim to be the....