'Pay attention' — Grayscale adds 18x the Bitcoin mined supply in one day

Bitcoin worth $600 million gets taken off the market as BTC/USD struggles to cement support for a retest of $40,000. Asset manager Grayscale added 18 times more Bitcoin (BTC) than miners added to the supply in just one day on Jan. 18.As various data sources confirm, Grayscale, which remains the biggest institutional buyer in the Bitcoin space, purchased a total of 16,244 BTC ($607 million) on Monday.BTC buys accelerate againThe giant sums are some of the biggest on record and are an order of magnitude above what even Grayscale was attempting just last week. The company previously saw daily....

Related News

Grayscale is continuing its BTC accumulation spree, snapping up more than 40,000 BTC in just 16 days. Digital asset manager Grayscale is showing little signs of slowing down its Bitcoin accumulation, adding around 40,000 BTC to its stash since January 13. That's around $1.36 billion worth of Bitcoin in just 16 days.The dramatic accumulation was noted by Rafael Schultze-Kraft, the CTO of crypto analytics firm Glassnode, who noted that only 26,000 BTC have been mined into existence since the start of the year. That means Grayscale has purchased Bitcoin at a rate that is 54% faster than new....

The investment firm purchased 17,100 BTC in the last week. Crypto fund manager Grayscale Investments has increased the assets under management in its Bitcoin Trust by more than $180 million over the past week.According to data from information platform Bybt, Grayscale added 17,100 Bitcoin (BTC) to the firm’s Bitcoin Trust in the last seven days. The company now has 449,900 total coins under management — worth roughly $4.9 billion with the crypto asset at $10,890, closing above $10,000 every day for the last 63 days.This effectively means Grayscale controls roughly 2.4% of total coin supply....

Grayscale brings its total assets under management above $20 billion in time for the start of 2021 as BTC demand intensifies. Institutional crypto investment giant Grayscale now has $20 billion under its control as its Bitcoin (BTC) buys outstrip production by almost three to one.As noted by data analysis resource Coin98 Analytics on Jan. 1, Grayscale bought almost three times more BTC than that which was added to the market in December 2020. It's official: Miners can't produce enough BitcoinLast month, the company added a total of 72,950 BTC ($2.132 billion) to its assets under management....

According to reports, Grayscale added 174,000 tokens to its litecoin holdings in the past month. This haul pushed its total holdings of the altcoin to 1.44 million. Following this acquisition, which represents 80% of all litecoin that were mined in the past month, the total value of Grayscale’s holdings of the altcoin is now just over $248 million. However, following the large acquisition by Grayscale Investments, LTC’s price movement appears to be unrelated to changing supply dynamics. For instance, Messari data shows that the altcoin only went above the $200 mark between....

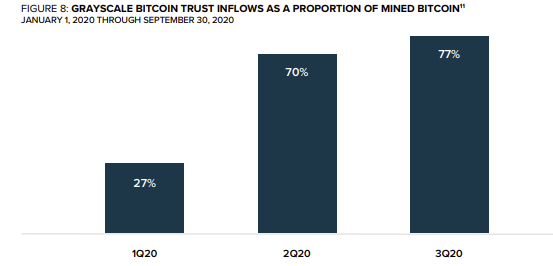

Bitcoin (BTC) traders and investors may face a supply deficit as major firms increase their stockpiling of the cryptocurrency, according to Dan Tapeiro of New York-based global macro fund DTAP Capital. “SHORTAGES of Bitcoin [is] possible,” the founder tweeted on Thursday. “Barry Silbert’s Grayscale Investments Trust is eating up BTC like there is no tomorrow. If 77 percent of all newly mined turns into 110 percent, then it’s lights out.” The statement came after Grayscale released […]