Centralized Exchange Operators Believe Low Liquidity on DEX Platforms Stops U...

Centralized cryptocurrency exchanges (CEX) operators say they are unfazed by the increasing trading volumes on decentralized exchanges (DEX) because the latter’s liquidity is still too insignificant to cause user mass migration. The majority of CEX operators also insist that it is very unlikely the DEXs’ liquidity would surpass their own liquidity in 2 years’ time. The comments by operators of CEX platforms come at the time when traded volumes on DEX applications are increasing courtesy of the rapidly growing Defi ecosystem. Underlining this growth is Uniswap’s....

Related News

Survey data show centralized exchanges are not worried about DeFi trading volumes, so why are they building their own DEXs? A recent survey by cryptocurrency data aggregator, CryptoCompare, shows that centralized exchange operators do not see the emergence of decentralized trading venues like Uniswap as a threat despite growing volume and activity in the DeFi space. In its September exchange review, CryptoCompare asked 26 of the leading venues in the space how likely it was for DEX liquidity to overtake that of centralized exchanges in a 2-year time span. 70% of those interviewed said that....

The Central Bank of Nigeria (CBN) recently announced the abrupt end to sales and outsourcing of foreign exchange to Bureau de Change (BDC) operators after accusing them of failing to stick to their core mandate. Instead of providing forex to retail users, BDCs are believed to be supplying the scarce resource to so-called “illegal” dealers. BDC Operators Accused of Fueling Parallel Market Activity The illegal dealers, in turn, avail the foreign exchange to clients at parallel market exchange rates. For instance, while the CBN insists that the naira’s exchange rate against....

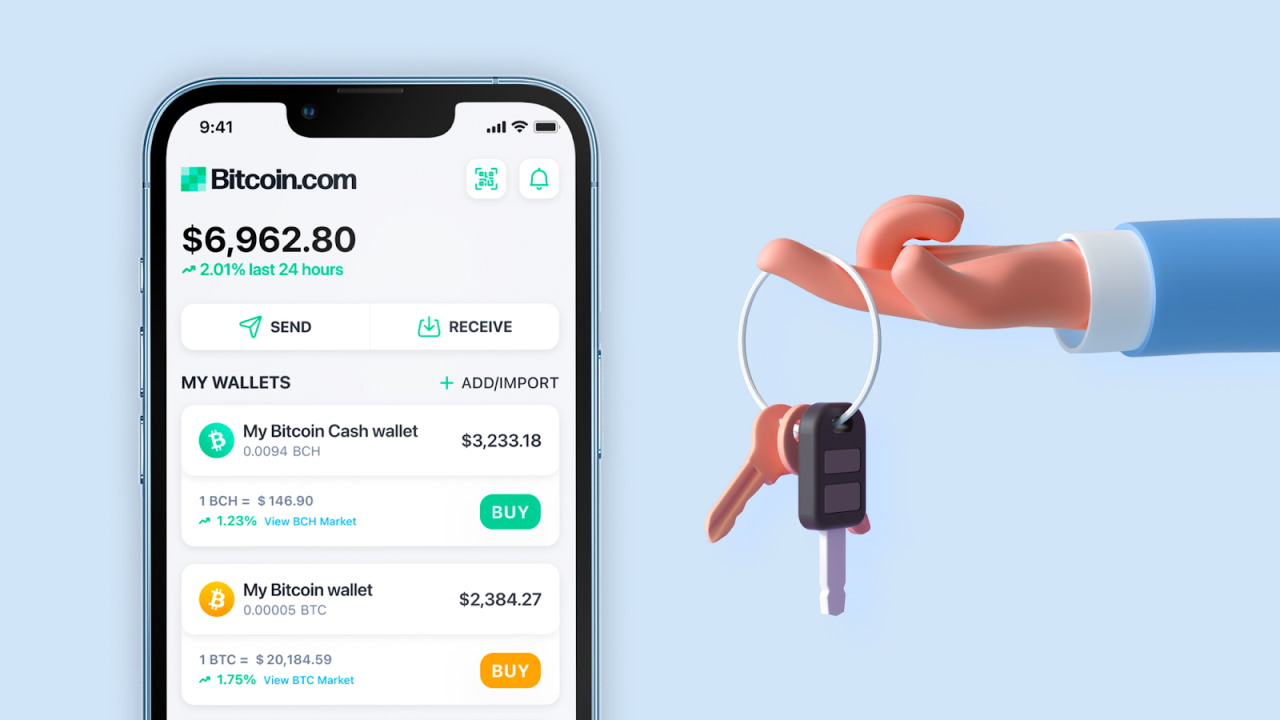

While markets are going up, people get more comfortable putting their cryptoassets into trusted third parties such as centralized exchanges and centralized lending platforms that promise increasingly enticing returns. The good times never last, though. As markets peak and monetary policy tightens, companies that overleveraged on the way up expose themselves to liquidity risks. If you deposited your cryptoassets into these products, perhaps unaware of their risk taking, your assets are exposed to their risks.

Not Your Keys, Not Your Coins

Pretty much everyone in crypto has heard....

Advertisements for Auroracoin, the Icelandic cryptocurrency, have begun to appear at bus stops all around the country. The advertisement, consisting only of “Auroracoin” in text and the coin’s logo on a white background. The advertisements are part of a public awareness campaign by the Auraráð, or Auroracoin, Foundation. According to Pétur Árnason, Auraráð Foundation chairman, these advertisements are meant to lay the groundwork for a resurgence of the Icelandic cryptocurrency later this year. “We have been preparing for Auroracoin promotion in Iceland for over a year now as we wanted to....

The world wide web was originally designed to be transparent, inclusive, and open to all. However, as technology progressed, the original vision was largely abandoned, leading to an overly centralized online ecosystem. Web 2.0, the version of the internet that we are currently living and most familiar with, has several drawbacks that we rarely discuss. Most of these problems stem from the fact that most Web 2.0 relies on digital identifiers. But what are these “digital identifiers,” and why do they matter? In the simplest terms, digital identifiers are used by third-party service providers....