Coinbase's Q2 profits top $1.6B as ETH volume surpasses BTC’s for the first time

Coinbase beat analyst estimates in Q2, after it generated $2.23 billion in revenue compared to estimates of $1.78 billion. Coinbase generated $2.23 billion of revenue for the second quarter of 2021, as Ethereum (ETH) trading volume surpassed Bitcoin (BTC) for the first time on the platform. Coinbase posted its Q2 report on Aug. 10 and the crypto exchange’s revenue beat analyst predictions — with industry standard financial estimators Refinitiv forecasting $1.78 billion in expected revenue for the firm. Coinbase’s earnings per share came in at $3.45, compared to estimates of $2.33. The....

Related News

Trading volumes for ETH increased by 1,461% over the first half of 2020. The world’s second-largest crypto asset has gained ground on Bitcoin in terms of trading volume growth during the first half of this year according to a new report.Ethereum’s trading volume grew faster than Bitcoin’s in the first half of this year according to a new report from leading U.S. crypto exchange Coinbase.The Coinbase Institutional H1 2021 in Review report, released on July 26, acknowledged that the first half of this year has been one of the most active periods on record for crypto, with several new....

DYdX volume tops Coinbase for the day, Cardano enables a new stablecoin, and a DeFi bounty hunter is highly rewarded — all coming to you this week in Finance Redefined. Welcome to the latest edition of Cointelegraph’s decentralized finance (DeFi) newsletter.DYdX surpassed Coinbase in daily trading volume for the first time this week. Read on to discover why this was a seminal moment for the project’s founder.What you’re about to read is the concise version of this newsletter. For the full breakdown of DeFi’s developments over the last week — released with more anticipation than a layer-two....

Bitcoin markets have been seeing a lot of action this weekend, as the price of the crypto asset touched another all-time high (ATH) at $28,378 per coin. Toward the end of 2020, the cryptocurrency’s market capitalization has crossed a whopping half of a trillion U.S. dollars in value. The leading cryptocurrency by market valuation, bitcoin (BTC), has climbed immensely in value during the last few days. At the time of publication, the asset is trading between $27,250 to $27,750 per BTC on Sunday morning (8-9:30 a.m. EST). A few days ago, on December 24, BTC was swapping for $23,796 per....

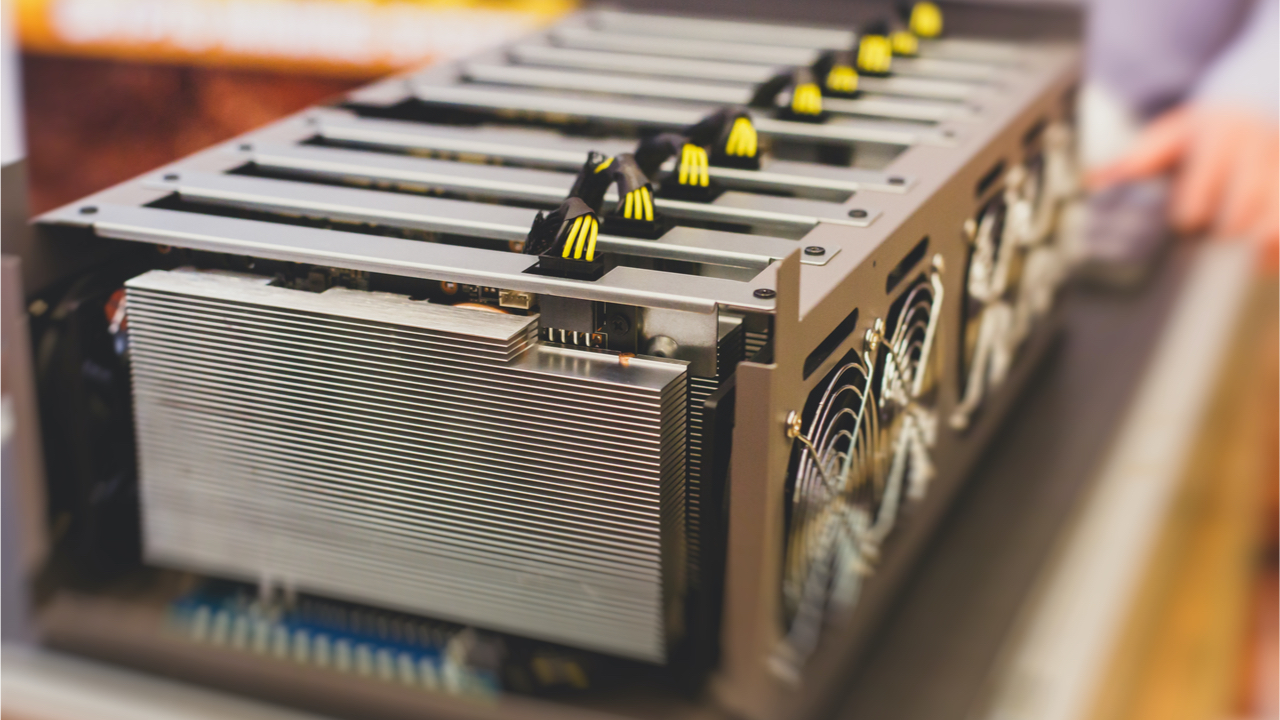

While bitcoin’s fiat value has dropped more than 70% below the all-time high recorded in November 2021, the price reduction has made it so miners are making fewer profits depending on the devices they operate. Despite miner profits sliding, Bitcoin’s hashrate has remained high coasting along at 180 exahash per second (EH/s) to 261 EH/s. In three days or more than 600 blocks away, Bitcoin’s next difficulty adjustment is also estimated to increase by 0.3%. Bitcoin Mining Revenue Keeps Getting Smaller — Fewer Machines Profit Miners continue to keep the hashrate....

On 17th March, Coinbase made the announcement that they were introducing stop orders to their Coinbase Exchange service, via a post on the Coinbase blog. Stop Orders Limit Losses. Investopedia defines a stop order as “an order to buy or sell a security when its price surpasses a particular point, thus ensuring a greater probability of achieving a predetermined entry or exit price, limiting the investor's loss or locking in his or her profit.” In the context of Bitcoin, “stop orders allow customers to buy or sell Bitcoin at a specified price. This order type helps traders protect profits,....