XRP Must Hold This Level To Avoid Transition To Macro Bear Structure

The XRP price was caught in the latest crypto market-wide selloff, falling to an intraday low of $1.57 within the past 24 hours. The sudden drop brings into focus XRP’s higher-timeframe structure, which is teasing a break below the 33-month exponential moving average. According to a technical assessment shared on X by crypto analyst Egrag Crypto, the recent drop below the 33-month exponential moving average does not automatically signal the end of XRP’s cycle, but XRP must close above an exact level to avoid a macro bearish confirmation. Related Reading: Ethereum Boost: Vitalik Buterin....

Related News

Bitcoin is facing a critical juncture as its macro retracement converges with a tight mid-range battle between $86,000 and $100,000. With bearish patterns confirmed and short-term support holding, the market now waits to see if bulls can reclaim momentum or if a deeper pullback is on the horizon. Bitcoin Confirms Macro Top: Bearish Phase Underway According to an update from Crypto Patel, Bitcoin appears to have confirmed a market top and is now transitioning into a broader macro retracement phase. The loss of a key bullish support level has shifted the market structure into a bearish....

Intended to convince market participants of a price correction, bear traps are orchestrated by entities with large holdings to make quick profits. How to identify and avoid a bear trap?As a difficult proposition for novice traders, a bear trap can be recognized by using charting tools available on most trading platforms and demands caution to be exercised.In most cases, identifying a bear trap requires the use of trading indicators and technical analysis tools such as RSI, Fibonacci levels, and volume indicators, and they are likely to confirm whether the trend reversal after a period of....

With XRP staring down the barrel of bears, there are now a number of levels that are important to watch as the month progresses. Crypto analyst EGRAG CRYPTO has outlined these important targets for investors to pay attention to, as they could be the make-or-break points for XRP. What To Watch Out For With XRP At the start of the analysis, the crypto analyst first implores investors to make sure that they adjust their perspective as things change. This is to ensure that they do not lose sight of the macro picture and are able to keep up with the market trends. That said, there are different....

Bitcoin (BTC) trades below $23,000 against Tether (USDT) after weeks of showing strong bullish signs as investors shift sentiments from bull to bear trap. The price of BTC failed to sustain its bullish structure as it breaks below zones leaving investors confused as Bitcoin trades just above the weekly key zone. Related Reading: Investor Sentiment Falls As Crypto Market Sheds $100 Billion Bitcoin (BTC) Trade Analysis On The Weekly Chart From the chart, the price of BTC saw a weekly low of $22,800, which bounced from that area and rallied to a price of $25,200 after showing great recovery....

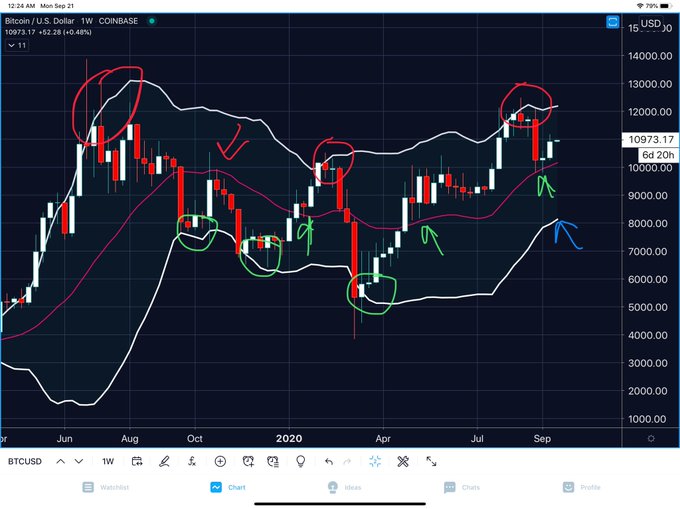

Bitcoin has entered no man’s land as it fails to pass $11,000 but is holding the low-$10,000s. The coin now trades at $10,900 as of this article’s writing, again below the aoforementioned support. Bitcoin actually may be in a positive spot, though, as it managed to hold a pivotal technical level of macro importance. Bitcoin Holds Pivotal Macro Support Level To some market participants, Bitcoin’s price action over recent weeks has been purely bearish. After […]