Bitcoin bear market over, metric hints as BTC exchange balances hit 4-year low

Coins stationary for at least a year are suggesting that accumulation is done — something which traditionally accompanies the end of bear markets. Bitcoin (BTC) may already be beginning its new macro uptrend if historical "hodl" habits repeat.That was the conclusion from research into the latest data covering the amount of the BTC supply dormant for one year or more as of July 2022.Hodled BTC hints that the bear market is overAccording to independent analyst Miles Johal, who uploaded the findings to social media on July 29, a “rounded top” formation in "hodled" BTC is in the process of....

Related News

Ethereum had seen its balances on exchanges decline through 2021. This happened despite continuous market rallies that sent the digital asset towards all-time highs. Investors had accumulated all through bull rallies instead of trying to dump their coins, leading to reduced supply on centralized exchanges. This was also propelled forward by the growing popularity of DeFi. However, this trend is starting to reverse as exchange balances are now on the rise. Ethereum Exchange Balances Touch 3-Month High New on-chain reports have shown that Ethereum exchange balances are on the rise once more.....

Puell multiple is an indicator that has historically given hints about previous Bitcoin cycles, here’s what it says about the current bear market. Bitcoin Puell Multiple Has Been Going Up During The Last Couple Of Months According to the latest weekly report from Glassnode, miners are currently raking in just 63% of the revenues of last year. The “puell multiple” is a metric that measures the ratio between the current Bitcoin miner revenues, and the 365-day moving average of the same. What this indicator tell us is how the miner revenues right now compare with the average....

Bitcoin has started a recent downtrend that is threatening its position above the coveted $40,000 level. This is presumed to be caused by major sell-offs in the market. However, exchange metrics continue to show that this is not entirely the case. Exchange balances have been plummeting for the past year pointing towards massive accumulation trends and this has come to a head after bitcoin exchange balances have touched a new 4-year low. Exchange Balances Plummet It is no secret that the bitcoin being left on centralized exchanges has been declining. However, the margin by which this has....

On-chain data shows the Bitcoin NUPL metric currently has values that would suggest the bear market is yet to hit in full swing, if the coin is in one. Bitcoin NUPL Value Still Not As Low As Previous Bear Markets As pointed out by an analyst in a CryptoQuant post, the BTC NUPL metric suggests market hasn’t neared a bear market bottom yet. The “net unrealized profile/loss” (or NUPL in short) is an indicator that tells us about the ratio of profit and loss in the Bitcoin market. The metric’s value is calculated by taking the difference between the market cap and the....

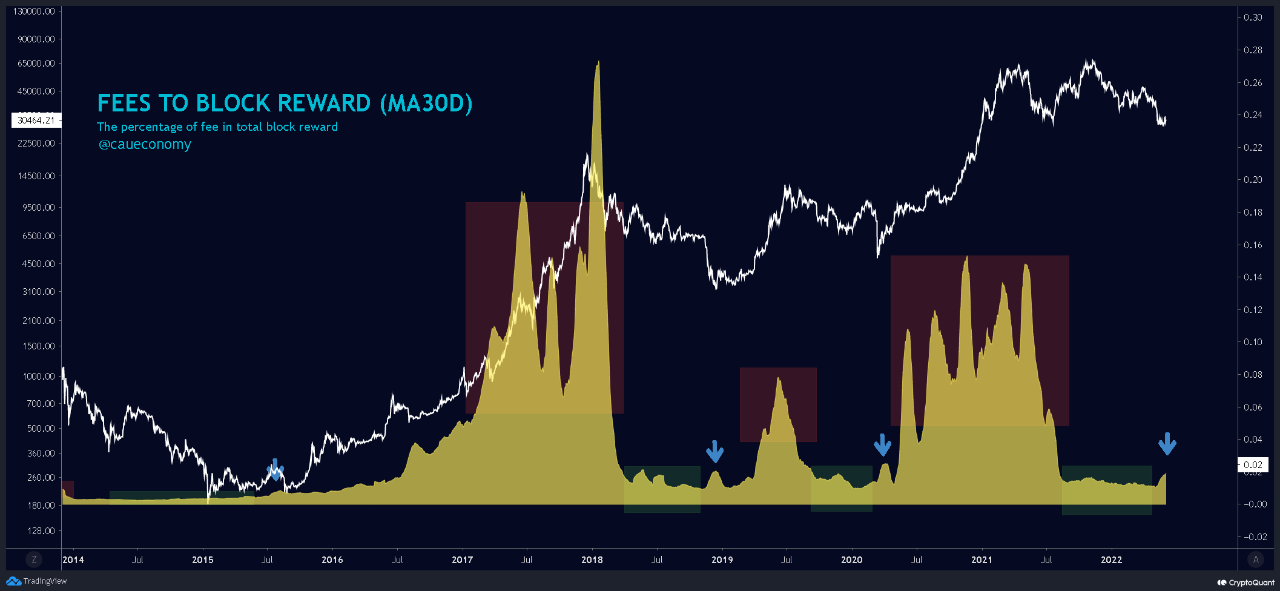

On-chain data shows recent trend in the Bitcoin transaction fees indicator may suggest that the crypto is now entering the late bear market stages. Bitcoin “Fees To Block Reward” Metric Has Gone Up Recently As pointed out by an analyst in a CryptoQuant post, the BTC fees metric may show that the bear market could […]