Stablecoin holdings on crypto exchanges hit a new all-time high

Stablecoins like Tether are flooding crypto exchanges again, potentially pointing at another upward move on crypto markets. Amid renewed bullish action on cryptocurrency markets, stablecoins like Tether (USDT) are flooding exchanges to hit a new historical high in terms of allocation.According to market data provider CryptoQuant, stablecoin holdings on global crypto exchanges broke a new all-time high on Jan. 28, surpassing $4.7 billion.This amount makes up a significant part of the total stablecoin market capitalization, which is estimated at around $35.2 billion at the time of writing,....

Related News

Cryptocurrency exchanges continue accumulating massive amounts of stablecoins like Tether and USDC Coin. Stablecoins like Tether (USDT) and USD Coin (USDC) have hit another milestone in terms of accumulation by exchanges.According to market data provider CryptoQuant, stablecoin holdings on global crypto exchanges soared to a new all-time high on March 28, exceeding $10 billion.Cryptocurrency exchanges are now holding nearly 16% of the total market value of all stablecoins, as stablecoin market capitalization amounts to $63 billion at the time of writing, according to data from CoinGecko.....

For the crypto market to fully enter another epic bull run, investors must be willing to purchase digital assets in large quantities. After a long stretch of abysmal performance, it looks like crypto investors are finally starting to believe in the market as they begin to pool their buying power to enter back into the market. Crypto Buying Power At 6-Month Highs An interesting development reported by the on-chain data tracker Santiment is the accumulation of Tether’s USDT stablecoin by crypto investors. As Santiment points out, the total amount of USDT being held on exchanges saw a notable....

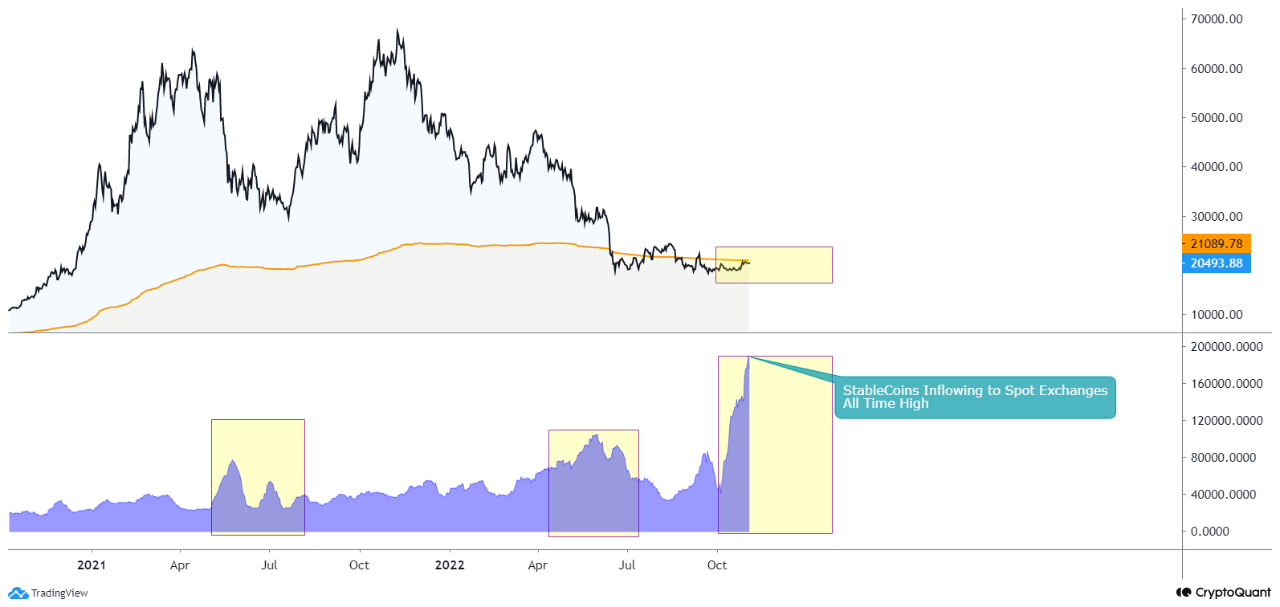

On-chain data shows the stablecoin exchange inflow mean has reached a new all-time high, here’s why this might prove to be bullish for Bitcoin. Stablecoin Exchange Inflow Mean Has Surged Up To A New ATH Recently As pointed out by an analyst in a CryptoQuant post, these inflows can be positive for Bitcoin in the long term, but might be bearish in the short term. The “stablecoin exchange inflow mean” is an indicator that measures the average amount of stablecoins per transaction going into the wallets of centralized exchanges. As stablecoins are relatively stable in value....

As Bitcoin (BTC) continues to trade in the high $100,000 range following the October 9 crypto market crash, some bullish signs are starting to emerge. Notably, stablecoin reserves on leading crypto exchanges like Binance are entering all-time high (ATH) territory, hinting at a potential rally for BTC. Stablecoin Reserves Rise – Will Bitcoin Benefit? According to a CryptoQuant Quicktake post by contributor PelinayPA, Binance stablecoin reserves are approaching ATH levels, indicating that investors are ready to deploy funds to accumulate BTC at current or lower levels. Related Reading:....

Whales with USDT holdings of $10,000 to $10 million added $1.06 billion worth of Tether to their wallets over the past month, increasing their buying power by 7%. Bitcoin (BTC) price struggled to overcome $40,000 resistance over the weekend and currently trading just above $38,000. At a time when BTC is hovering at a 40% discount from all-time highs, whales have started accumulating more stablecoins.According to data from Santiment, stablecoin whales with wallet holdings of 10,000 to 10 million Tether (USDT) have accumulated over $1 billion in buying power in the past month. The data....