Bitcoin Takes it in the Shorts (Op-Ed)

It’s a new year and a new crop of obituaries for bitcoin, following a dramatic price decrease over a 48-hour period starting in the wee hours of January 13, almost immediately following a dire warning by ex-Wall Streeter George Samman in this very publication a few days earlier predicting such a collapse was necessary to find the bottom of the current bear market and that the recent price declines were far too orderly. Samman is the co-founder and ex-COO of BTC.sx, a service that lets users short bitcoin (among other financial leveraging instruments). How convenient. It was a well-written....

Related News

The entire market capitalization of all 10,800 cryptocurrencies in existence is down 2.8% on Monday as bitcoin has lost over 2.4% during the last 24 hours. Meanwhile, bitcoin shorts are rising again after bitcoin shorts tapped a two-year high on the derivatives exchange Bitfinex on June 25. Bitcoin Shorts Climb Higher Bitcoin (BTC) and digital markets, in general, have seen better days as BTC tapped an all-time high above the $64K handle three months ago but is still down 48.66% since then. Roughly 17 days ago, on Bitfinex, the number of BTC/USD short positions skyrocketed to levels not....

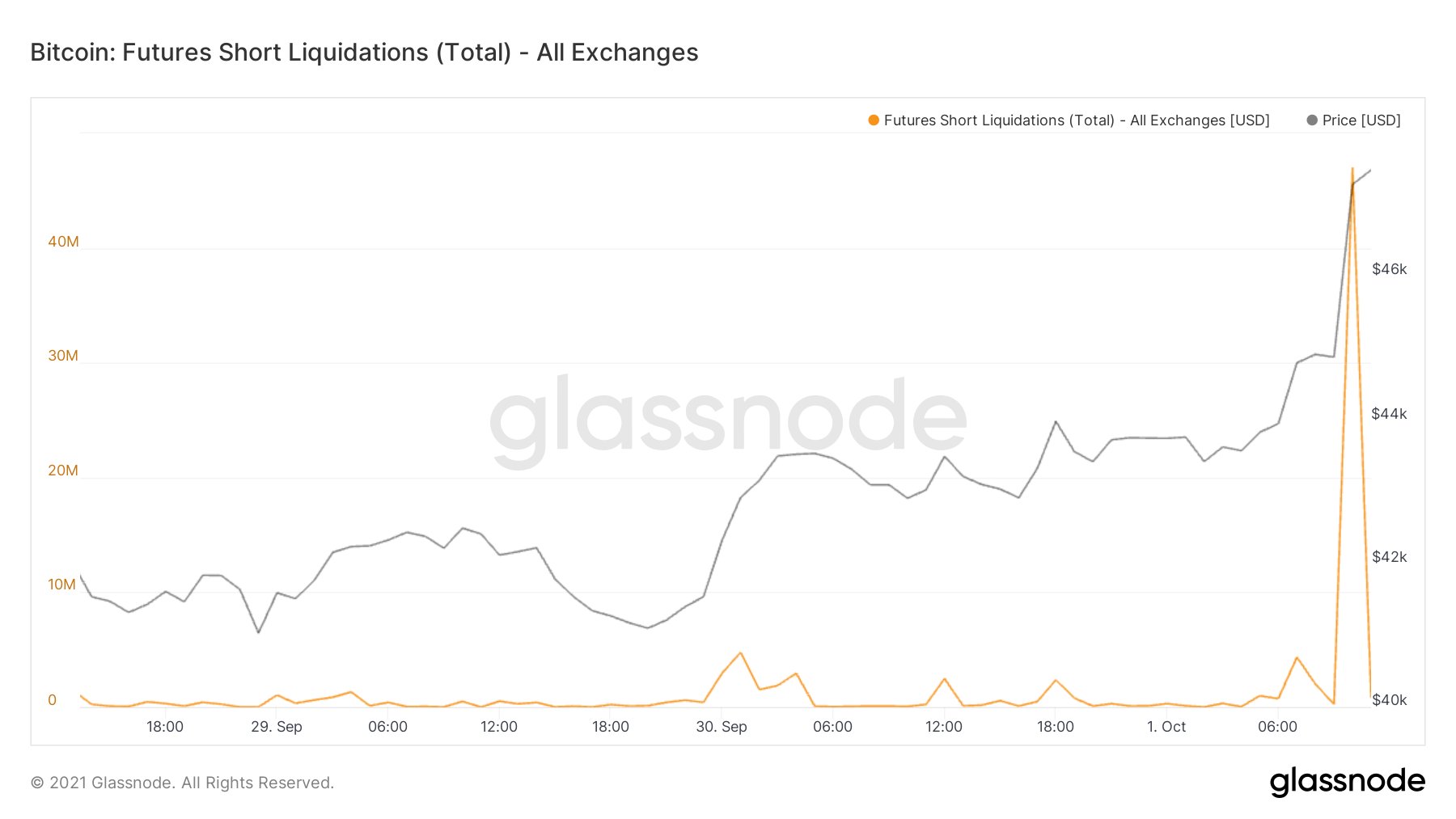

After today’s incredible Bitcoin move where the price climbed to $47.5k, shorts worth around $47 million liquidated within an hour. $47,000,000 In Bitcoin Futures Shorts Liquidate Within Just An Hour As pointed out by an analyst on Twitter, around $47 million in Bitcoin futures shorts have liquidated within an hour today. If you don’t know […]

Bitcoin has recently fallen below a $32,000 critical hold point and in response, retail investors have taken this as an opportunity to make money from the falling bitcoin price. So far, retail investors have started loading up on shorts, an incredibly bearish metric for the market. Retail investors load up on shorts | Source: Twitter […]

This third edition of Cycling On-Chain takes a closer look at bitcoin’s ongoing supply squeeze and recent short squeeze.

The shorts were liquidated after Elon Musk added "Bitcoin" to his Twitter bio and prices rose by over 15%.