Blade Financial to Bring Debit Cards to Bitcoin Businesses

Today Blade Financial launched as the first B2B payment processing platform extending traditional debit card programs to bitcoin businesses. Blade makes it fast, easy, and compliant for digital currency companies to offer their customers a familiar way to spend bitcoin at millions of merchants worldwide.

Blade Financial CEO Ed Boyle previously served as General Manager of the Prepaid Card Business at American Express. In his role, Boyle was repeatedly creating and bringing to market industry firsts, from the first on-statement database marketing, to the first microchip-enabled corporate card, and the first open-loop/network-branded gift card.

Additionally, Blade is comprised of payments experts that have launched over 30 card programs worldwide with over $1 billion in annual transactions. The team has an average 15+ years of direct industry experience and comes from noteworthy institutions like AMEX and Total System Services (TSYS).

Despite support from major retailers like Dell, DISH Network and Overstock.com, bitcoin's annual transaction volume currently represents less than one percent of the $7.4 trillion in purchases processed through Visa and Mastercard last year. The reality is, consumers just don't have enough ways to spend their cryptocurrency.

"It's the age old chicken and egg problem: which comes first, merchants or consumers?" said Blade Financial Co-Founder and CEO Ed Boyle. "Blade takes away half of the equation by fully solving for the merchant side."

Today, 80% of people own debit cards. They provide a convenient way for consumers to make purchases, and remain the number one form of payment over cash or credit. Every bank outsources its card program, and now digital currency companies can offload merchant adoption to Blade so they can focus on their core business of acquiring and retaining users.

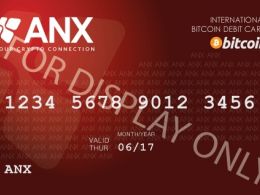

The Blade engine integrates digital currency companies with banks via a REST API to deploy white label and co-branded debit cards that work over existing global payment networks. Blade transactions are instant; the digital currency is debited real-time at the point of authorization and no pre-funding of fiat is required.

About Blade Financial

Blade Financial makes it fast, easy and compliant to launch your own bitcoin debit card. Founded in 2014 and based in New York, NY, the company is led by Ed Boyle, the former GM of Prepaid Cards at American Express and a 20+ year payments industry veteran. Blade is a Platform-as-a-Service offering digital currency businesses both white label and co-branded bank debit cards for their customers.

To learn more about Blade Financial, visit http://www.bladefinancial.com/

Related News