Quant Explains How US Stock Market Volumes Influence Bitcoin Price

A quant has explained how there is a connection between the recent trends in the US stock market volumes and the Bitcoin price. TradFi Depth Oscillator Has Hit A Low And Is Now Turning Back Up As explained by an analyst in a CryptoQuant post, the volume depth in traditional finance markets has been low recently. The “TradFi volume” is a measure of the total amount of transactions that buyers and sellers are making on the US stock market. There is a concept called “market depth,” which is the ability of any market to take in large orders without impacting the price....

Related News

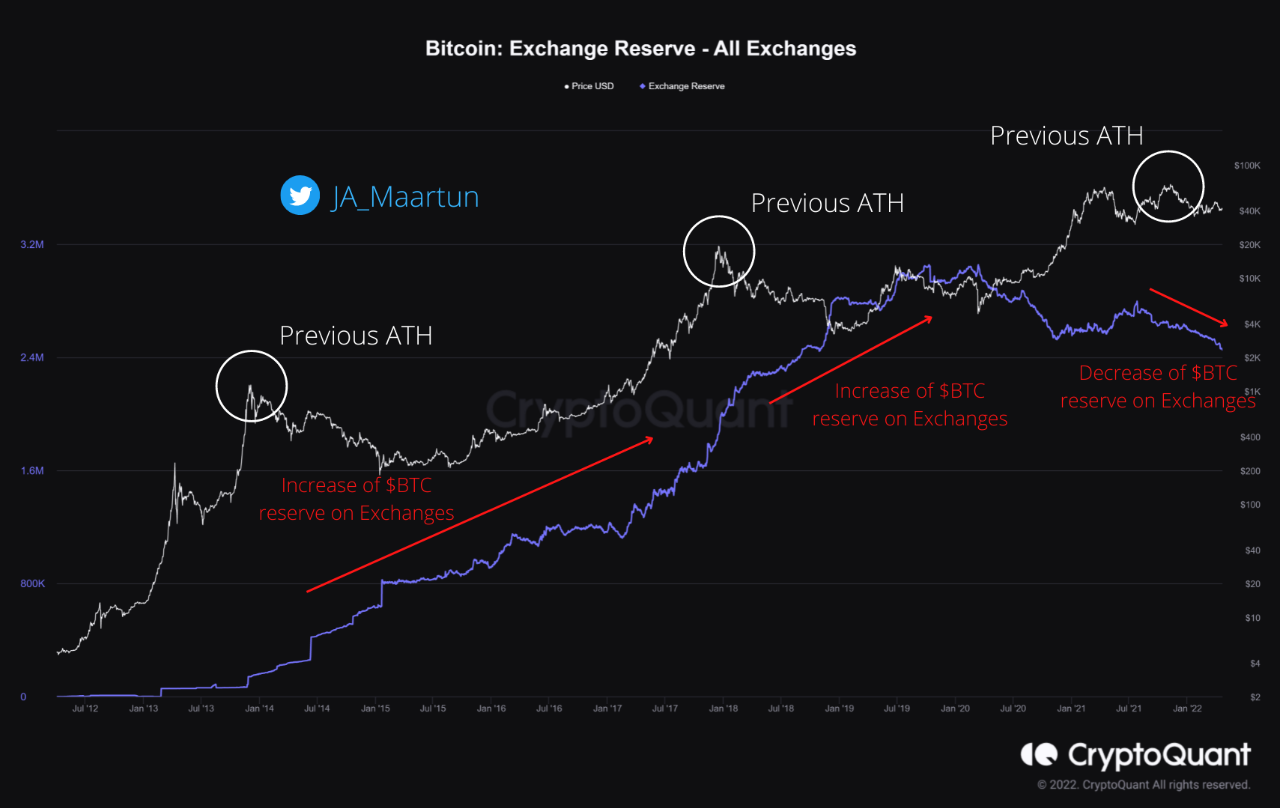

A quant has explained using on-chain data why the current Bitcoin bear market looks to be different from the previous ones. Quant Suggests This Bitcoin Bear Market Is Unlike The Rest As explained by an analyst in a CryptoQuant post, the exchange reserve continuing to trend down since the price all-time high isn’t typical of […]

Puell multiple is an indicator that has historically given hints about previous Bitcoin cycles, here’s what it says about the current bear market. Bitcoin Puell Multiple Has Been Going Up During The Last Couple Of Months According to the latest weekly report from Glassnode, miners are currently raking in just 63% of the revenues of last year. The “puell multiple” is a metric that measures the ratio between the current Bitcoin miner revenues, and the 365-day moving average of the same. What this indicator tell us is how the miner revenues right now compare with the average....

While the broader crypto market continues to linger in bear territory, one cryptocurrency continues its steep climb undeterred and now occupies rank #27 in the top cryptocurrencies by market capitalization. Related Reading: TOP 5 Cryptos To Watch This Week – BNB, BTC, ETH, QNT, LEO Quant (QNT) was trading at half its price exactly one month ago. Today, QNT broke through the $200 mark for the first time since November last year and is currently writing its fifth weekly green candle, according to TradingView. At the time of writing, Quant is trading at $216. Apparently, the QNT is currently....

Despite being a lesser-known cryptocurrency, Quant has held gains while top coins, including Bitcoin, have fallen in value. The price of Quant had fallen along with the rest of the crypto market at the start of the year. However, it has slowly experienced growth since then, trading at $157 at press time. This is over 248% gain from its yearly low of $44.42 on June 17. Quant’s weekly and three-month charts have also been in the green. Its weekly chart shows that the coin has been on an uptrend for the past two weeks. The coin has seen some volatility, but it has been able to hold onto....

Quant (QNT) has been a shining star in the cryptocurrency market recently, posting a remarkable 28% gain in just seven days. As the price of Quant (QNT) climbs to new heights, savvy investors are beginning to look for new opportunities with even greater profit potential. Enter Mpeppe (MPEPE), a meme coin that has been gaining […]