Crypto regulation concerns make decentralized stablecoins attractive to DeFi ...

The threat of stablecoin regulation and USDT and USDC centralization are making decentralized stablecoins like MIM, FRAX and UST attractive to DeFi investors. Stablecoins have emerged as a foundational part of the cryptocurrency ecosystem over the past couple of years due to their ability to provide crypto traders with an offramp during times of volatility and their widespread integration with decentralized finance (DeFi). These are necessary for the health of the ecosystem as a whole. Currently, Tether (USDT) and USD Coin (USDC) are the dominant stablecoins in the market, but their....

Related News

A new report by the European Central Bank (ECB), presented as a “deep dive into crypto financial risks,” calls for “appropriate” regulation and oversight of stablecoins and decentralized finance (defi). It also addresses the hot topic of Bitcoin’s carbon footprint in Europe, suggesting a ban on proof-of-work mining is probable. Growth of Stablecoins, Defi Warrants Regulation and Supervision, ECB Says Crypto-related financial risks, those associated with stablecoins and defi platforms in particular, as well as the threat to climate transition goals blamed....

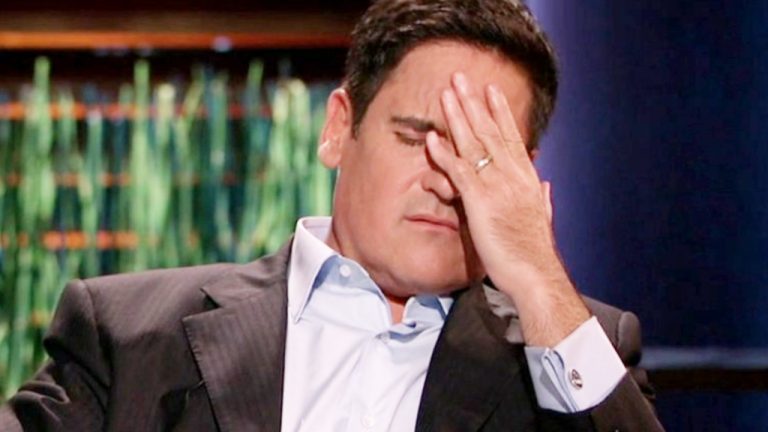

Billionaire investor and Shark Tank star Mark Cuban has called for cryptocurrency regulation focusing on decentralized finance (defi) and stablecoins after a token he invested in collapsed from $64 to near zero. Cuban Wants Defi and Stablecoin Regulation After Investing in Collapsed Token The billionaire owner of the NBA team Dallas Mavericks, Mark Cuban, invested in a token that crashed from about $64 to near zero Wednesday. Iron Finance called the collapse of its iron titanium token (TITAN) “the world’s first large-scale crypto bank run.” The price of the token is....

The U.S. lawmaker claimed that the value of stablecoins would “take a nosedive,” with small investors largely feeling the effects of a potential downturn. Massachusetts Senator Elizabeth Warren did not hold back in her criticism of decentralized finance (DeFi), expressing concern about how a run on stablecoins would affect the average investor.In a Tuesday hearing with the Senate Banking Committee discussing stablecoins, Warren questioned Hilary Allen, a professor at the American University Washington College of Law, as to whether a run on stablecoins could potentially endanger the United....

A commissioner with the U.S. Securities and Exchange Commission (SEC) expects to see stricter regulation on stablecoins. However, Treasury Secretary Janet Yellen says stablecoins are currently “not a real threat” to the country’s financial stability. SEC Commissioner on Stablecoin Regulation The regulation of stablecoins has been a hot topic this week following the Terra fiasco which saw UST losing its U.S. dollar peg and LUNA plunging to near zero. A commissioner with the U.S. Securities and Exchange Commission (SEC), Hester Peirce, talked about cryptocurrency....

Ruling the headlines on the BSC network is now a norm for the Mars Ecosystem. Armed with some of the highest APRs in the DeFi space and an ever-growing TVL, the team recently earned a Monthly Star in the Binance Smart Chain “Most Valuable Builders” program and is working towards reinventing the utility of Stablecoins. With BSC supporting Mars’ products and technology, it adds a layer of credibility to the constantly evolving Mars ecosystem. In this write-up, we will deep dive into stablecoins and what Mars Ecosystem means to the future of DeFi and crypto. Stablecoins were first....