Here is how one algorithmic indicator anticipated multiple phases of FXS’ pro...

Altcoins can rally for an infinite number of reasons, but some price spikes are more historically similar than others. Frax Share (FXS) has been one of the few altcoins to pull off a dominant price performance amid the down market of late 2021 to early 2022. In the month between Dec. 14 and Jan. 14, FXS was up 128% against the U.S. dollar and 159% against Bitcoin (BTC). In addition to this impressive feat, FXS topped the charts of historically bullish trading conditions on multiple occasions throughout this period. What is behind the token’s recurring strong trading outlook?Governing a....

Related News

Glassnode has talked about the four phases of Bitcoin accumulation and distribution during the past year in their latest report. Bitcoin Accumulation Trend Score Shows Market Has Been Selling Recently As per this week’s edition of the weekly Glassnode report, the market has observed four distinct phases in the last twelve months. The relevant indicator […]

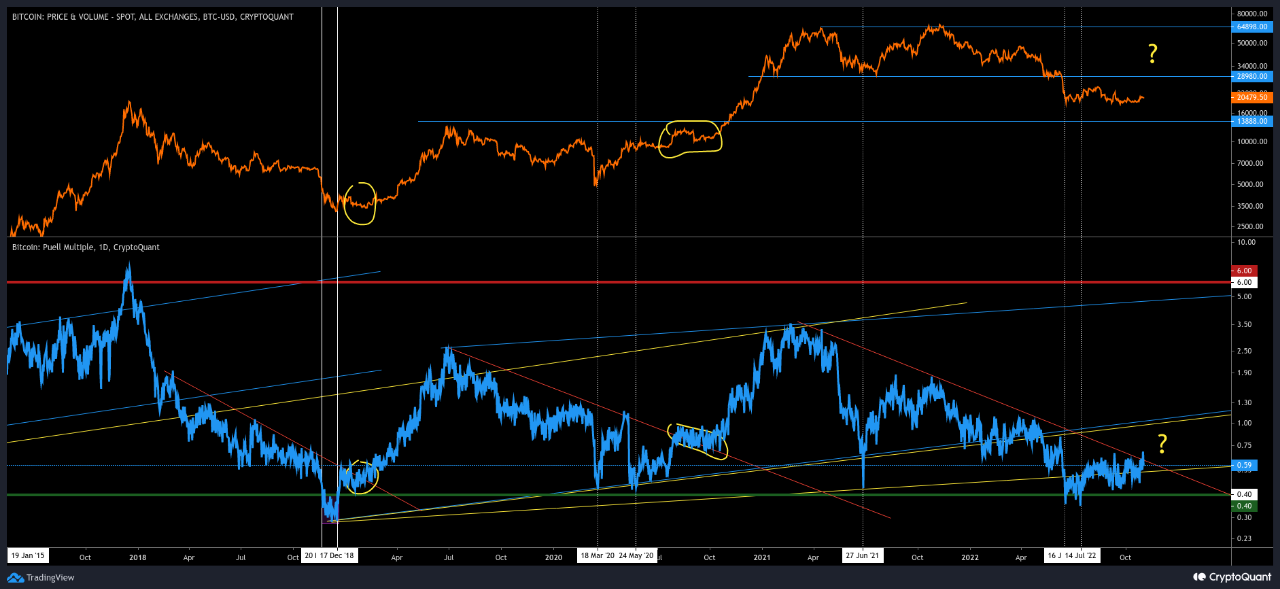

Top Quant uses the puell multiple to point out a pattern that explains why the current Bitcoin bull cycle is only in the first phase. The Bull Market Is Not Over, Phase 1 Has Just Begun According to a CryptoQuant analyst, past cycles show that the current Bitcoin bull market isn’t over yet. The puell multiple seems to reveal where the price might head next. The puell multiple is a BTC indicator used to tell how healthy miners’ revenue is. It’s calculated by dividing the mining revenue by the 365-day moving average (MA) of the same. Puell Multiple= Mining Revenue USD ÷ 365....

Are algorithmic stablecoins trying to clone the intrinsic qualities of fiat money or dollar; like security? The recent craze over algorithmic stablecoins has stirred mixed reactions from the crypto community. For crying out loud, it has been an emotional contagion for crypto enthusiasts everywhere. So, is it overkill? Are algorithmic stablecoins too ambitious? Suggested Reading […]

My working chart, showing Bitcoin price candles, grey volume bars, fractal highs(^) and lows(v), trendlines, support / resistance levels, Fibonacci retracement levels, MACD indicator and Moon Phases. I've discussed the use of all the indicators and line studies on my chart in previous articles, particularly this one. The only new addition this time is Moon Phases - note the two white full moons and two blue new moons in close proximity to price. Moon Phases show the extremes of the moon's waxing / waning cycle. I've included them as these lunar periods marked the last three significant....

On-chain data shows the Bitcoin Puell Multiple is currently retesting the downtrend line, will the metric be able to break above it this time? Bitcoin Puell Multiple Has Gone Up A Bit During Recent Days As pointed out by an analyst in a CryptoQuant post, a trend reversal could be nearing in the BTC market. The “Puell Multiple” is an indicator that measures the ratio between the current daily Bitcoin mining revenues (in USD) and the 365-day moving average of the same. What this metric tells us is how much the BTC miners are making right now compared to the average during the....