More billionaires turning to crypto on fiat inflation fears

The number of billionaires that have invested in crypto increased last year, and that trend could continue into 2022 as fears over fiat intensify. Previously anti-crypto investors are increasingly turning to Bitcoin and its brethren as a hedge against fiat currency inflation concerns.One example is Hungarian-born billionaire Thomas Peterffy who, in a Jan. 1 Bloomberg report, said that it would be prudent to have 2-3% of one’s portfolio in crypto assets just in case fiat “goes to hell”. He is reportedly worth $25 billion.Peterffy’s firm, Interactive Brokers Group Inc., announced that it....

Related News

The American business magazine Forbes recently published the company’s 2021 documentation of the wealthiest billionaires in the world. According to the list published annually every March, there are now 12 billionaires that work directly within the cryptocurrency industry and the list of crypto billionaires is 3x larger than last year. Today’s Crypto Billionaires List Since March 1987, Forbes has been publishing a list of the world’s wealthiest billionaires compiled in a list for the public to view. Back then the Japanese businessman and real-estate mogul Yoshiaki....

In a post-pandemic world where countries have spent over $20 trillion on stimulus, the fear of inflation is a real thing, and many people have been looking for a way to get past it. All hopes seem to have been lost in fiat currencies which is why many are turning to cryptocurrencies. MoneyTime offers users […]

Gold disappointed investors in 2021 as a traditional hedge against inflation, seeing its worst year since 2015. Bitcoin (BTC), the world’s most-valued cryptocurrency, has replaced gold as an inflation hedge for young investors, according to Wharton’s finance professor.Gold’s performance was “disappointing” in 2021, Wharton School finance professor Jeremy Siegel said in a CNBC Squawk Box interview on Friday.On the other hand, BTC has been increasingly emerging as an inflation hedge among younger investors, Siegel argued:“Let’s face the fact, I think Bitcoin as an inflation hedge in the....

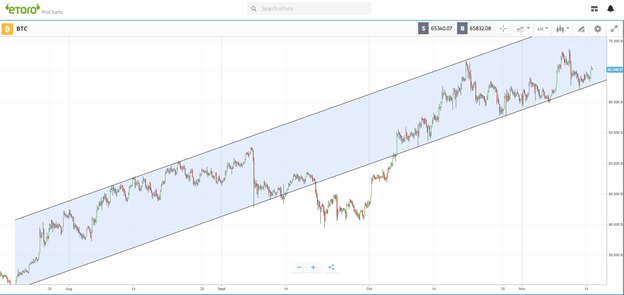

The rush to so-called safe-haven cryptocurrency appears despite concerns that the Federal Reserve would taper its $120 billion a month asset purchasing program. Bitcoin (BTC) inched higher on Sept. 18 as the focus shifted to the Federal Open Market Committee's (FOMC) policy meeting in the wake of lower inflation numbers last Tuesday.The BTC/USD exchange rate approached $49,000 on the Coinbase exchange, hitting $48,825 before turning lower on interim profit-taking sentiment. Nonetheless, the move uphill raised expectations that the pair would hit $50,000, a psychological resistance target,....

First major upgrade in four years set to accelerate Bitcoin innovation After briefly eclipsing all-time highs on shocking inflation figures, Bitcoin settled down to finish the week with 2% losses as the long-awaited Taproot upgrade was activated At its peak on Wednesday, Bitcoin flirted with the $69K level. Within a few hours however, fresh fears […]