BENQi brings DeFi to the masses with a low-cost, high-speed liquidity market

Decentralized Finance (DeFi) is still nascent despite the rapid growth over the last couple of years. It has a long runway for growth ahead. However, congestion problems on Ethereum and the subsequent high network fees have forced millions of DeFi-curious people to stay away from decentralized liquidity markets. Avalanche-based algorithmic liquidity market BENQi is addressing […]

Related News

PRESS RELEASE. BENQI, an algorithmic liquidity market protocol, and the Avalanche Foundation are collaborating on a joint liquidity mining program to celebrate the launch of the BENQI protocol on the 19th of August and the next phase of growth within Avalanche’s DeFi ecosystem. $3MM of AVAX will be allocated as liquidity incentives for BENQI users, with additional incentive programs coming soon. The AVAX will be offered as rewards to users who are lending and borrowing AVAX, ETH, LINK, wBTC, USDT, and DAI on the protocol with BENQI. AVAX is the native token of Avalanche. It’s....

BENQI, Avalanche’s first & only unicorn, is a very intriguing company. With nearly $2 billion in total value locked, the DeFi protocol is getting noticed by many people. Algorithmic liquidity will play a crucial role in the future development of decentralized finance solutions and products. What Is BENQI Exactly? As a company founded by individuals involved in Ethereum and its DeFi ecosystem, BENQI’s team acknowledged the potential of blockchain and crypto assets early on. Although Ethereum’s blockchain has technical limitations leading to scaling concerns and high....

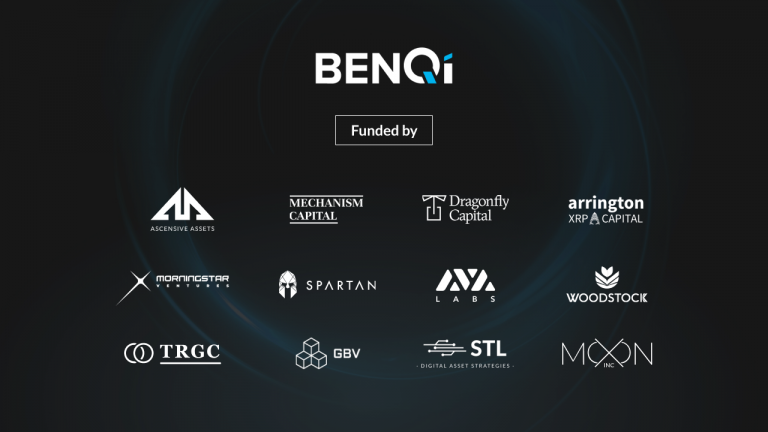

BENQI, a non-custodial liquidity market protocol built on Avalanche, announced the completion of its $6 million strategic fundraising round, led by Ascensive Asset. The list of other strategic investors included Mechanism Capital, Arrington XRP Capital, Dragonfly Capital, MarketAcross, TRGC, Spartan Group, Woodstock Fund, and more. Explaining the importance of this investment, BENQI stated that it […]

Total value locked across DeFi is fast approaching record highs again, suggesting that crypto is in the second leg of its bull market. Liquidity market protocol BENQI has reached $1 billion in total value locked, or TVL, less than a week after launching on the Avalanche (AVAX) network, a major milestone that highlights the explosive growth of decentralized finance (DeFi) lending services. Benqi Finance announced the milestone on Twitter late Sunday, where it thanked its community for the overwhelming support. Absolutely speechless... Thank you everyone for the overwhelming support.....

PRESS RELEASE. BENQI, a liquidity market operating on the Avalanche network, has completed a private funding round. A total of $6 million was raised in a round led by Ascensive Assets. A number of leading investors on blockchain and the emerging Avalanche ecosystem also participated. These include Mechanism Capital, Dragonfly Capital, Arrington XRP Capital and The Spartan Group. Other backers were Morningstar Ventures, Vendetta Capital, TRGC, Genesis Block, Woodstock and Rarestone alongside Ava Labs and leading liquidity provider Skynet Trading. Built on Avalanche’s highly scalable....