MicroStrategy Stock Has Gained 452% In First Year On Corporate Bitcoin Standard

One year since adopting a corporate Bitcoin standard, MicroStrategy's stock has exploded as the bitcoin price has risen 306%.The below is from a recent edition of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.“This is not a speculation, nor a hedge. It is a deliberate corporate strategy to adopt the Bitcoin Standard.”These were the words of CEO Michael Saylor following the announcement of MicroStrategy’s move to adopt a corporate bitcoin standard.....

Related News

Microstrategy (MSTR) has “outperformed every asset class and big tech stock” since the company adopted a bitcoin strategy and started accumulating the cryptocurrency in its corporate treasury, says CEO Michael Saylor. The pro-bitcoin executive will be stepping down as the CEO of Microstrategy and take the role of the company’s executive chairman to focus on bitcoin.

Microstrategy’s Performance Since Adopting Bitcoin Strategy

The Nasdaq-listed software company Microstrategy Inc. (Nasdaq: MSTR) released its Q2 financial results Tuesday. CEO Michael....

MSTR stock has surged by roughly 113% since Dec. 8 when it was downgraded by a Citigroup analyst. On Dec. 8, 2020, Citigroup, one of the largest banks in the world, downgraded MicroStrategy'ss stock (MSTR). Since then, MSTR stock is up 113.27% from $289.45 to $617.31, as the price of Bitcoin (BTC) rallied.In the same period, the Citigroup stock has declined slightly by 0.63%, from $58.36 to $57.99.MicroStrategy stock vs. BTC and Nasdaq. Source: ecoinmetricsWhy has MicroStrategy stock performed so strongly despite the downgrade?MicroStrategy has been investing its treasury holdings in....

Michael Saylor’s MicroStrategy plans to raise $21B for additional Bitcoin ($BTC) purchases through the At The Market (ATM) Program. Specifically, MicroStrategy will sell $21B worth of 8% Series A perpetual strike preferred stock – shares that pay an 8% dividend, have a $0.001 par value, and are convertible into MicroStrategy’s Class A common stock without […]

MicroStrategy is by far the largest corporate Bitcoin holder on the planet with 105,084 BTC on its books. Entities under Michael Saylor's control hold more than 111,000 BTC. Capital International Group, a $2.3 trillion asset manager headquartered in Los Angeles, has acquired a 12.2% stake in MicroStrategy — making it one of the largest indirect investors in Bitcoin (BTC) on the planet. According to a filing with the United States Securities and Exchange Commission, or SEC, Capital International Group now holds 953,242 MSTR stock worth roughly $560 million at current prices. Only BlackRock....

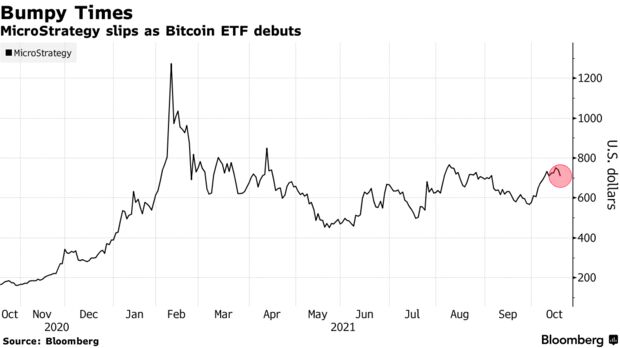

Following the launch of the first ever Bitcoin exchange-traded fund (ETF), Microstrategy’s stock took a hit. This may show that investors would prefer to get BTC exposure through the ETF rather than the tech company’s stock. Microstrategy’s Stock Drops 2% In Response To Bitcoin ETF Launch As reported by Bloomberg, the tech firm’s stock had […]