Decentralized and traditional finance tried to destroy each other but failed

Crypto to prevail over the traditional financial system, instead, competing industries started to adopt each other's technologies and cooperate. The year 2022 is here, and banks and the traditional banking system remain alive despite decades of threatening predictions made by crypto enthusiasts. The only endgame that happened— a new Ethereum 2.0 roadmap that Vitalik Buterin posted at the end of last year. Even though with this roadmap the crypto industry would change for the better, 2021 showed us that crypto didn't destroy or damage the central banks just like traditional banking didn't....

Related News

There is an enormous shift in finance toward digital solutions over the last several years, and that trend has only kicked into overdrive since 2020. The need for frictionless, decentralized solutions to the aging traditional finance system has led to the emergence of cryptocurrencies and decentralized finance. Early DeFi projects laid the groundwork and provided “proof of concept” that the industry has potential and would replace traditional finance. Still, too many early tokens came in […]

It won’t be easy to bring DeFi to be on par with traditional finance, but tokenization can help it along, says Liquefy’s CEO. Nonfungible tokens could become a bridge to connect the legacy financial system to the emerging fintech world in the near future. During a recent interview, Adrian Lai, CEO of Liquefy — an investment firm and an incubator for decentralized finance platforms — told Cointelegraph China that synthetic assets, NFTs and digital securities are redefining the way capital markets operate. Lai especially believes that the value of synthetic assets could give each individual....

Education and accessibility are crucial to make DeFi more accessible to the upcoming inflow of retail investors. Engaging in the traditional financial markets has become less appealing to consumers and institutional investors as of late. New opportunities are plentiful, with decentralized finance getting a lot of attention. However, that new movement is not without its risks and flaws, either.For decades, consumers and institutional investors have explored the many different options presented to them in the financial world. This approach has worked out rather well, as one could even earn....

Alkemi Network positions itself as a decentralized liquidity network introducing institutional DeFi. More specifically, the project wants to bridge traditional finance with decentralized finance in a meaningful and lasting way. The team behind this project has a clear vision for the future and can change the finance industry at its core. What Is Alkemi Network? […]

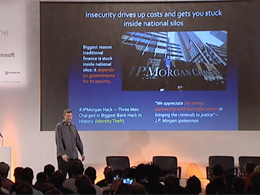

Smart contracts pioneer Nick Szabo has lauded the security benefits of decentralised monetary systems built using blockchain technology. Speaking at Ethereum'sDEVCON1 conference, held in London today, Szabo - often rumored to be the creator of bitcoin - gave an overview of the blockchain's history and highlighted the security inefficiencies of centralised systems typically used by traditional finance institutions. Centralisation is insecure, said Szabo, before noting mainstream finance's reliance on government and law enforcement officials for security: "This is one of the reasons why....