While Stocks Rebound, Analysts Discuss Bitcoin’s Decoupling, Gold Markets Rem...

U.S. equities markets jumped on Thursday as stock traders saw some relief after a number of weekly losses. All the major stock indexes rebounded after falling for nearly eight weeks in a row, while the crypto economy took some losses on Thursday, losing roughly 4% against the U.S. dollar during the past 24 hours. Meanwhile gold has been hanging below the $1,850 per ounce mark as Kitco’s Neils Christensen says gold markets remain “under pressure, seeing no major buying momentum.” Analyst Says ‘Doom and Gloom’ Predictions ‘May Have Been....

Related News

Bitcoin price has rallied more than $300 intraday, meanwhile, the S&P 500 has fallen almost ten basis points in the same time period. Is this the fabled stock market crypto “decoupling” that analysts claimed was coming, or is this just an anomaly before a return to the ongoing correlation between the vastly two different markets […]

For the past few months, Bitcoin’s price action has largely been beholden to legacy markets like the S&P 500, the U.S. dollar index, and gold. The cryptocurrency has crashed and surge intandem with these markets, suggesting it is not uncorrelated as many once said. While this may be true in the short term, analysts think that the markets will decouple eventually. Bitcoin Is Primed to Decouple From the S&P 500, Top Analyst Says Willy Woo, […]

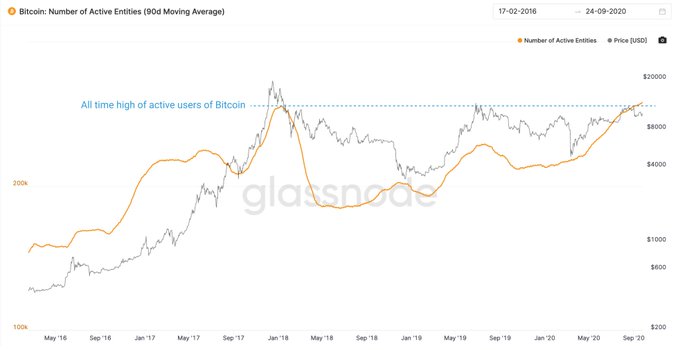

BTC used to be an uncorrelated asset, but that’s no longer the case. What can gold and stocks suggest about the crypto markets? Bitcoin (BTC) is an uncorrelated asset, or so the narrative used to go. For much of Bitcoin’s lifetime, it existed as something of value to a very small group of people. Now, awareness and demand are accelerating rapidly. So, what does this mean for the status of BTC as a supposedly uncorrelated asset? That Bitcoin was an uncorrelated asset isn’t just conjecture — the numbers back it up. According to data compiled by VanEck in early 2021, there was almost no....

Bitcoin’s decoupling from stocks began within days of its NVT price hitting an all-time high, according to Willy Woo. Bitcoin (BTC) has started to decouple from the U.S. stock market index S&P 500 according to crypto statistician Willy Woo. First signs of de-coupling behaviour spotted between BTC and stocks. Buying from an influx of new users provides price support preventing speculators from trading the correlation downwards. NVTP approximates a valuation for BTC with organic investor velocity on the blockchain. pic.twitter.com/AvilB9cfdD— Willy Woo (@woonomic) October 29, 2020....

According to analyst Lyn Alden, bitcoin's correlation to stocks or gold depends on bitcoin’s own cycle.