Bitcoin Rallies While Stocks Stumble: Is The Correlation Decoupling Finally H...

Bitcoin price has rallied more than $300 intraday, meanwhile, the S&P 500 has fallen almost ten basis points in the same time period. Is this the fabled stock market crypto “decoupling” that analysts claimed was coming, or is this just an anomaly before a return to the ongoing correlation between the vastly two different markets […]

Related News

Bitcoin (BTC) and U.S. stocks have shown a negative correlation lately, with Bitcoin often moving in the opposite direction of traditional markets. This divergence has caught the attention of analysts and investors, especially as the cryptocurrency enters a period of consolidation along with the broader crypto market. Historically, shifts in this correlation—from negative to positive—have often signaled a bullish trend for Bitcoin. Related Reading: Battleground At $60,000: Bitcoin Faces Pivotal Test As Bulls Aim To Reclaim Key Support As both markets face challenges, the changing dynamics....

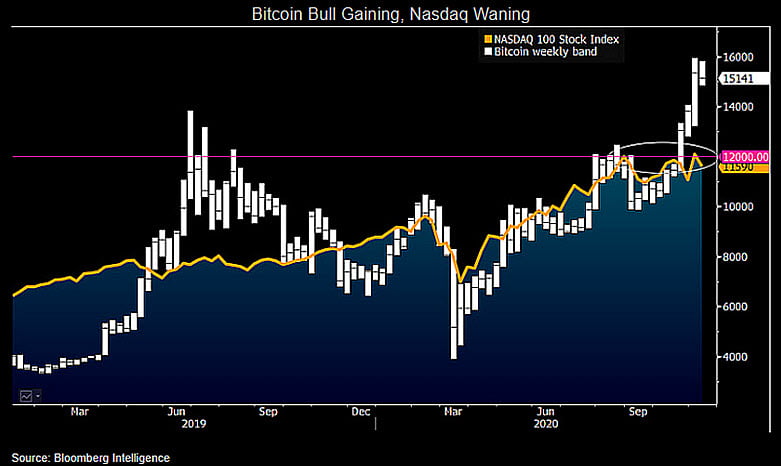

Bitcoin's growth has quickly outpaced Nasdaq's in the past ten years. A potential decoupling scenario between Bitcoin (BTC) and the Nasdaq Composite can push BTC price to reach $100,000 within 24 months, according to Tuur Demeester, founder of Adamant Capital.Bitcoin outperforms tech stocksDemeester depicted Bitcoin's growing market valuation against the tech-heavy U.S. stock market index, highlighting its ability to break out every time after a period of strong consolidation. "It may do so again within the coming 24 months," he wrote, citing the attached chart below.BTC/USD vs. Nasdaq....

Bitcoin is finally breaking its correlation with the stock market, which has been persisting despite its recent uptrend’s strength. An example of this correlation’s lingering effects can be seen while looking towards yesterday’s selloff, with the rejection at $13,800 coming about almost instantly after investors saw a sharp decline in stock futures. Although yesterday was […]

Bitcoin is on track of further price appreciation as it decouples from a classic positive correlation with tech stocks, according to Mike McGlone of Bloomberg Intelligence. On Wednesday, the senior commodity strategist highlighted the ongoing trend deviation between the flagship cryptocurrency and the Nasdaq 100 Stock Index — a benchmark that tracks the market performance […]

Bitcoin held onto its weekly gains as traders waited for US Congress to agree on the second coronavirus package on Tuesday. The benchmark cryptocurrency added $67, or 0.5 percent, to trade near $11,827 ahead of the New York opening bell. Likewise, the US stocks inched higher in the pre-trading session, renewing its positive correlation with […]