Bitcoin goes mainstream as institutions hold 3% of BTC’s circulating supply

The growing appetite of institutional investors means companies now hold more than 460,000 BTC, which is 3% of the total supply in circulation. Institutional investors are rapidly gobbling up Bitcoin, and at the time of writing, nearly 3% of the Bitcoin (BTC) in circulation are locked up in long-term holdings by these investors.Data shows that 24 entities have amassed more than 460,500 BTC, which is equivalent to $22 billion at Bitcoin's current price.According to Michael Novogratz, this figure excludes the 3 million BTC forever lost, who estimates that a supply shortage could occur....

Related News

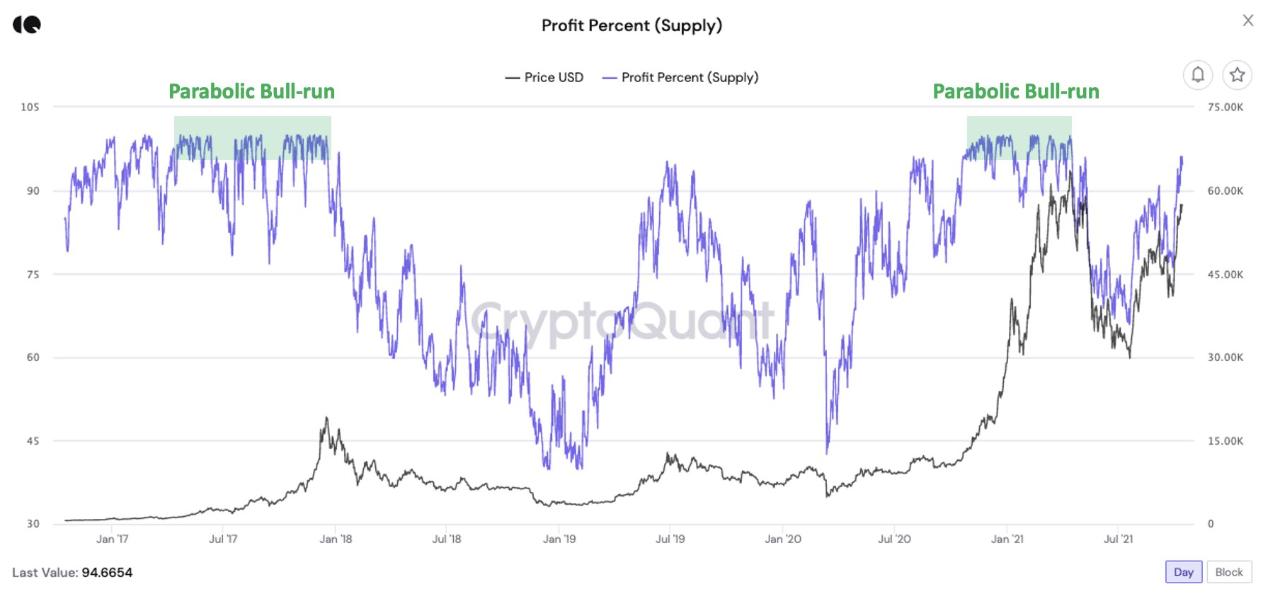

On-chain data shows 99% of the circulating Bitcoin supply has unrealized profits again. History may have the hint for where the market could head next. 99% Of The Circulating Bitcoin Supply Has Unrealized Gains As pointed out by a CryptoQuant post, the profit percent of the circulating BTC supply has reached 99% once again as […]

Bitcoin is undergoing a structural transformation, and institutional investors are steadily tightening their grip on the cryptocurrency. As of mid-2025, institutional investors are becoming a dominant force in Bitcoin ownership and are steadily capturing a large portion of its circulating supply. Institutional Bitcoin Holdings Barrel Toward 20% Of Supply Recent data shows that institutions, ranging from ETFs to public companies, now control an unprecedented share of Bitcoin, worth hundreds of billions of dollars. Estimates place institutional ownership anywhere between 17 and nearly 31....

A prominent crypto analyst has suggested that the actual XRP circulating supply is much lower than most realize. With demand for tokens expected to rise from areas such as tokenized debt, gold, and stablecoins, XRP’s seemingly limited supply could tighten even more, leaving the market exposed to a sudden squeeze. XRP’s True Circulating Supply Limited […]

Circulating, maximum and total supply are all essential metrics for an investor’s price discovery. Find out here what they are and how they can be used. Total supply vs. maximum and circulating supplyCirculating and maximum supply are equally important in their own use, and understanding their implication vs. the total supply can help assess their impact on the cryptocurrency’s price.How a price may change in the future is a crucial assessment for an investor who could plan a different strategy depending on how each metric performs against the total supply. Total and circulating supply can....

Market capitalization and asset supply factor into prices, but could any token be worth $1 million one day? At the time of publication, one Bitcoin (BTC) values $47,247, while one Dogecoin (DOGE) is worth around $0.068. If you are new to crypto or markets, you may initially think: Hey, DOGE is cheaper than Bitcoin, and if it picks up enough steam, maybe it could catch up to BTC and rise over $20,000, too. This way of thinking, however, is illogical. Why? Market capitalization and asset supply. Market cap is the combined dollar value of an asset’s circulating supply. It changes as the value....