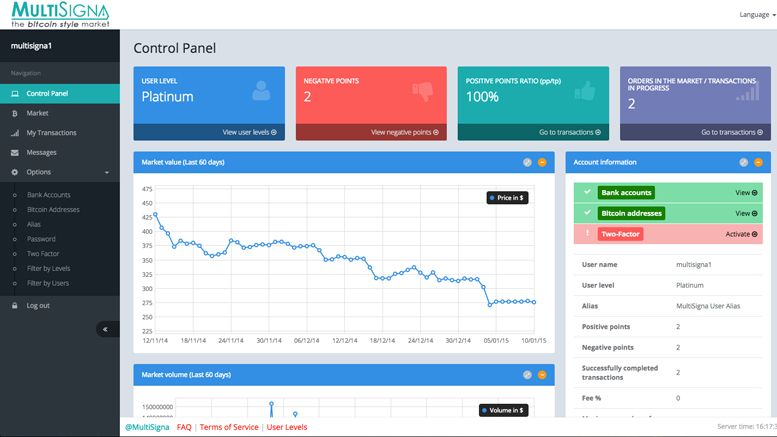

MultiSigna: The Bitcoin Market Exclusively Using Multi-Signature Wallets

A new bitcoin market recently came on the radar that’s looking to shake up the way people think about buying and selling bitcoin. Over the past year, the bitcoin community has been beaten by hacks and thefts all over the map due to incompetent exchanges holding their funds. From stories like Mt.Gox to Bitstamp, it seems like almost no one is safe that operates in a centralized manner.

But now, the exchange called MultiSigna wants to change all that by utilizing only multi-signature wallets.

“Would I trust an exchange enough to let them store my fiat money and my cryptocurrency, or would I rather operate in a market where the fiat money and cryptocurrency go directly from one user to the other, and not to the exchange’s accounts and addresses?” MultiSigna asked in an interview with CCN.

Typically, traders hand their money over to an exchange in order to buy and sell on their market. Unfortunately, this all gets lumped into a centralized source that’s susceptible to hackers – either from the outside or the inside. With MultiSigna, the exchange never holds user’s funds because they’re set up in a 2-of-3 multisig wallet.

How MultiSigna Works

The way it works is simple: the customer holds two private keys themselves while the exchange holds one. In order to move funds out of the wallet, two keys must be entered. If the exchange is compromised, hackers still can’t move the funds because two keys are held by the customer. If one of the customer’s private keys are lost, the exchange can step in and halt the transaction using their private key upon request.

In other words, every aspect of the trade is out of MultiSigna’s hands unless there’s a dispute. They don’t keep coins on their server, and they don’t initiate transactions by themselves. In fact, some people believe multisig technology is the highest level of security bitcoin users can utilize today.

MultiSigna said that using this technology makes security the main focus.

“Storing bitcoins in multi-signature addresses makes the security increase exponentially, as long as the private keys that authorize the transactions are stored in different places. A hacker that enters a server and has access to the private keys stored in that server cannot steal the bitcoins, it’s also necessary to have the private keys of the rest of the clients that will be stored in their computers. And much less if the client’s key is in a cold wallet.”

In addition, MultiSigna believes their platform can help in the fights against the manipulation of the bitcoin price.

“An exchange, no matter how big it is, cannot influence the dollar or euro price,” they said. “But in a market that is so small, in relative terms, as is the bitcoin market, an important exchange where the clients have accounts with ‘balances’ similar to a bank account, but in bitcoins, it is possible to influence the price.”

MultiSigna can’t do this though because the bitcoins people are trading are always in the user’s hands. From day-traders to casual buyers and seller, the market is open to everyone who thinks multisig is the way to go.

Related News