Nervous newbies are taking profits while long-term BTC investors hodl strong

Despite short-term Bitcoin trading spiking in January, wallets that have been inactive for at least three years are the largest segment of the BTC holders. Long-term Bitcoin hodlers appear not to be selling despite 2021’s all-time highs, while nervous newbies have been taking profits along the way.According to Unchained Capital’s “Hodlwaves” chart — which visually illustrates the time since BTC wallets were last active on-chain, 2021 has seen an increase in both long and short-term activity.Hodlwaves: Unchained CapitalThe chart shows the number of coins that have moved in the past 30 to 90....

Related News

Bitcoin on-chain data reveals that speculators and long-term holders have become increasingly confident of higher prices as their selling activity has slowed down significantly. For the very first time in a Bitcoin (BTC) bull market, not only long-term investors but also short-term speculators who usually add to the daily sell pressure toward the end of a market cycle have become increasingly confident of higher prices as they hold on to their Bitcoin.This only adds to the already existing supply shock. If demand remains strong, this is a recipe for another leg up for the BTC price.Bitcoin....

Yesterday, December 30, the price of Bitcoin closed at $425. Recall that at the beginning of the year the price of Bitcoin was $313. Growth for the year was 26.35%. Investors yesterday continued to take profits at the end of the year, market volatility has been low, and the price could not fall below the support level of $420. As we expected, the whole day yesterday the price of Bitcoin fluctuated within the corridor $420 - $440. In the Asian session also, special adjustments are not made. We asked Bitcoin expert Tomi Hrovatin from Slovenia, when will the bullish trend resume for Bitcoin?....

In the ever-evolving world of decentralized finance (DeFi) and cryptocurrency, investors are constantly on the lookout for altcoins that offer both short-term gains and long-term stability. Among the myriad of options, Aave (AAVE) and Mpeppe (MPEPE) have emerged as two standout choices for those seeking reliable, long-term profits. While both projects operate in different niches, […]

On-chain data shows that while miners are selling less BTC, old investors are realizing profits. On-chain analytics provider, Glassnode, has published data revealing that Bitcoin miners are accumulating while long-term investors are taking profits.Despite January seeing heavy selling from miners, Glassnode’s report shows that miner outflows have dried up during February so far.Chart - Glassnode.comThe report asserts that miners and longer-term investors are the two principal sellers of Bitcoin during bull markets. According to Glassnode, declining miner outflows can be inferred as bullish,....

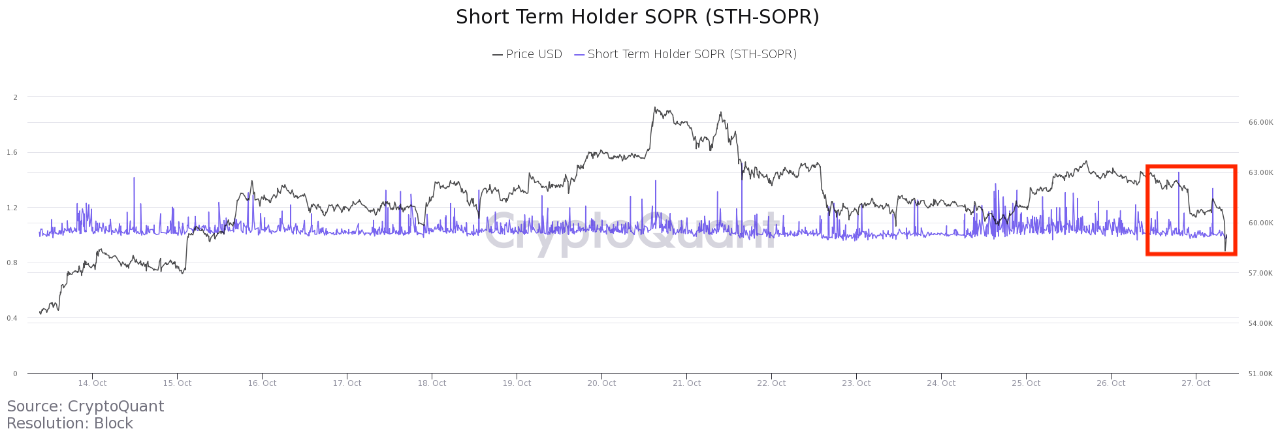

Bitcoin has crashed to $58k, and on-chain data may suggest that profit-taking from short-term holders may be behind the event. On-Chain Data Shows Bitcoin Short-Term Holders Are Taking Profits As pointed out by an analyst in a CryptoQuant post, short-term holders seem to have started taking their profits. And the timing may suggest this to […]