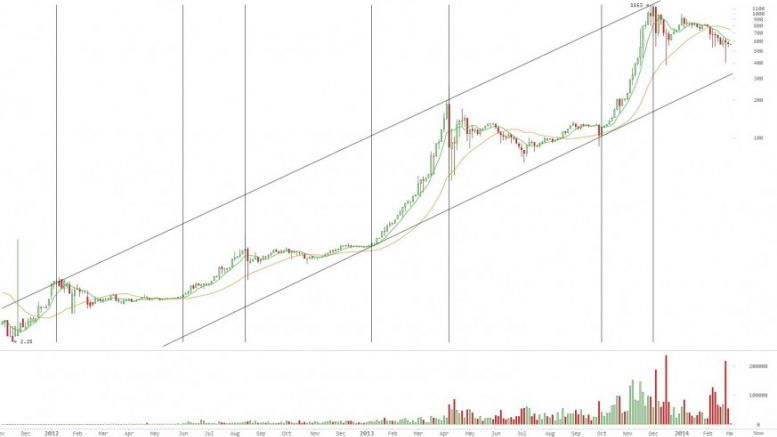

Bitcoin Technical Analysis Indicates Near Mid Cycle Low

The purpose of this article is to advise that, on a time frame cyclic basis, we are at the normal time that a low is formed in the Bitcoin market. This means that if the market performs as it has in the past, which is certainly no guarantee, we may be near the low point between periods of price advances. Typically, Bitcoin follows phases similar to those described in 'Dow Theory'. Spotting the low in these phases is crucial to good investment timing. Normally the best time to buy follows the end of a 'bear' market. At this time, pessimism is at a maximum and prices have already fallen....

Related News

Don’t be alarmed by the current slump in the bitcoin price. In fact, there is still cause for optimism. The market is going through a reversal pattern to the $700 level, where a congestion area should reinforce quotes for another climb to $820, keeping us right on track to hit the projections advanced last week. Bitcoin Price Analysis: Bulls Still in Control. Long-Term Analysis. After testing the lowest support at the $580-$600 level, prices should enter an upward reversal pattern soon, which will allow an initial pull back to $700, extended to Fibonacci´s technical objective at $820. The....

Bitcoin remains at the same price level from last week, reinforcing the $600 support area for the entire new cycle. Meanwhile, technical analysis indicates that bullish consensus is getting stronger, increasing the likelihood of a rally from $650 to $820. 5th Elliott Wave forecasting, based on Fibonacci numbers, could be calculated to the technical objective around the $820 area, where several theories point to the delayed next stage. From there, a technical correction should send prices back to $700, giving stragglers a second chance to recalculate their strategies to join. After another....

The Ethereum price is drawing attention to its potential future outlook, as a crypto pundit points to a striking resemblance between the altcoin’s price action and Bitcoin’s during the 2015-2017 bull cycle. The analyst’s technical chart analysis suggests that ETH is destined for a breakout to $10,000 this cycle, marking new all-time highs. Ethereum Price […]

The bitcoin price has accomplished its first technical cycle, and a congestion area could institute a trading box for the next 3 months, depending on fundamentals, political factors and news before a new rise to the annual objective near $1800 USD. Prices had arrived to their long term technical objective, ending the cycle. Now, a trading box could take place in the chart before starting the next long-term technical cycle, which has its long term resistance at $1800. According to indicators, the support of a wide congestion area would be at $600, and the first resistance at the old....

Bitcoin is falling down to end its current cycle, which will happen when prices drop to the technical reversal level. Prices have started the dive to $600 and $580 after a large lateral sideways lateral movement that ended the first technical cycle. To start a new cycle, quotes must reach former broken resistances, which become supports. Once this occurs, strong purchases are expected, framed in the marketplace of biggest players. Looking back in the chart, another two flags can be analyzed, which have broken to the bear side. This time, the Contrary Opinion Theory could be considered to....