IRS Virtual Currency Guidance: Bitcoin Is Treated as Property for U. S. Federal Tax Purposes

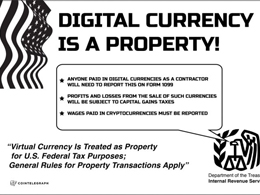

In a recent IRS News Release, America's Internal Revenue Service reveals their Virtual Currency Guidance. While Bitcoiners are busy watching the Coinsummit livestream, the IRS Virtual Currency Guidance that was promised many months ago has been leaked. The most noteworthy points are right in the title: Virtual Currency Is Treated as Property for U. S. Federal Tax Purposes. General Rules for Property Transactions Apply. Here is the full release: IRS Virtual Currency Guidance: Virtual Currency Is Treated as Property for U. S. Federal Tax Purposes. General Rules for Property Transactions....

Related News

The Treasury Inspector General for Tax Administration recently released a paper on taxation of virtual currencies including Bitcoin, officially requesting the IRS to provide guidance for tax treatments of digital currencies and develop a strategic approach. Based on the 2014 tax guidance for virtual currencies released by the Internal Revenue Service (IRS), digital currencies like Bitcoin are considered labeled as property for tax purposes. The report of the US treasury reads: “The notice provides that virtual currencies should be treated as property for tax purposes. The same general tax....

Just in time for the income tax filing deadline comes a news release from the Internal Revenue Service (IRS) regarding the taxation of bitcoin and other digital currencies. In short, the notice states that virtual currency shall be treated as property for federal tax purposes in the United States. Some interesting points: Virtual Currency not treated as currency that can generate foreign currency gains/losses. Taxpayers are liable for determining the fair market value of their virtual currency. Taxpayers must report gains/losses upon exchange from virtual currency to fiat currency, for....

Another eventful week at CCN. We learned that the United States Internal Revenue Service (IRS) is treating bitcoin as property for tax purposes, that the bitcoin price dropped below $500, that transaction malleability did not bankrupt Mt. Gox, and more. Here are our top stories for the week of 24 March - 30 March in case you missed them. [youtube http://www.youtube.com/watch?v=shkvBF6n1DY?rel=0]. IRS Virtual Currency Guidance. The IRS is treating virtual currencies as property for tax purposes. The United States has finally set some clear rules regarding taxation of bitcoin. According to....

The United States’ tax agency, the Internal Revenue Service, clarified its position on cryptocurrencies Tuesday in a statement. The Internal Revenue Service today issued a notice providing answers to frequently asked questions (FAQs) on virtual currency, such as Bitcoin. These FAQs provide basic information on the U.S. federal tax implications of transactions in, or transactions that use, virtual currency. In some environments, virtual currency operates like “real” currency — i.e., the coin and paper money of the United States or of any other country that is designated as legal tender,....

Digital currency enthusiasts might have a new reason to enjoy the Big Apple. The state of New York has recently labeled bitcoin as "intangible property," which means that any purchase or transaction made with bitcoin will not be subject to sales tax. In a recent memorandum, the New York State Department of Taxation and Finance explains: "The use of convertible virtual currency by a customer to pay for goods or services delivered in New York State is treated as a barter transaction. For sales tax purposes, convertible virtual currency is intangible property. Since the purchase or use of....