IRS will tax cryptocoins as property, not currency

The United States’ tax agency, the Internal Revenue Service, clarified its position on cryptocurrencies Tuesday in a statement. The Internal Revenue Service today issued a notice providing answers to frequently asked questions (FAQs) on virtual currency, such as Bitcoin. These FAQs provide basic information on the U.S. federal tax implications of transactions in, or transactions that use, virtual currency. In some environments, virtual currency operates like “real” currency — i.e., the coin and paper money of the United States or of any other country that is designated as legal tender,....

Related News

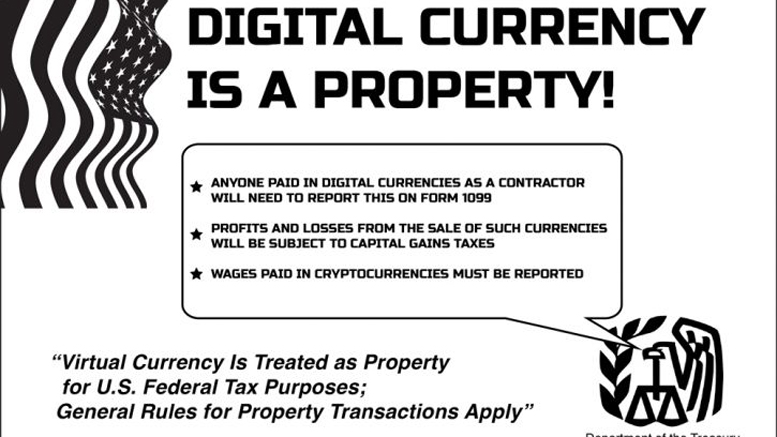

In a recent IRS News Release, America's Internal Revenue Service reveals their Virtual Currency Guidance. While Bitcoiners are busy watching the Coinsummit livestream, the IRS Virtual Currency Guidance that was promised many months ago has been leaked. The most noteworthy points are right in the title: Virtual Currency Is Treated as Property for U. S. Federal Tax Purposes. General Rules for Property Transactions Apply. Here is the full release: IRS Virtual Currency Guidance: Virtual Currency Is Treated as Property for U. S. Federal Tax Purposes. General Rules for Property Transactions....

Does the IRS really want you to track your capital gains on bitcoin every time you buy a sandwich or a sweater in the digital currency? After our analysis of the Internal Revenue Service guidelines on bitcoin, released in March, some people expressed surprise. They were amazed that the IRS could seriously be applying capital gains rules to something that the bitcoin community sees as a currency, and which in many cases uses as such. "This can't be good for bitcoin", said one commenter privately to Coindesk. "If it's not a currency, then how are you supposed to use it like one?" But as far....

Another eventful week at CCN. We learned that the United States Internal Revenue Service (IRS) is treating bitcoin as property for tax purposes, that the bitcoin price dropped below $500, that transaction malleability did not bankrupt Mt. Gox, and more. Here are our top stories for the week of 24 March - 30 March in case you missed them. [youtube http://www.youtube.com/watch?v=shkvBF6n1DY?rel=0]. IRS Virtual Currency Guidance. The IRS is treating virtual currencies as property for tax purposes. The United States has finally set some clear rules regarding taxation of bitcoin. According to....

The MicroStrategy boss thinks Bitcoin is a form of property and points out that the U.S. Government is not threatened by other forms of property. MicroStrategy CEO Michael Saylor thinks that Bitcoin is more like digital property than digital currency.He was speaking on the July 15 edition of the “Coin Stories” podcast with host Natalie Brunell. Asked if he thought that Bitcoin was a threat to the U.S. dollar Saylor replied:“I would call it a digital property, it's a threat to property, it's particularly a threat to other forms of property: gold is property, real estate is property. I don't....

Bright Side of News recently published an article entitled: LiteCoins is Causing Shortages of AMD Radeon GPUs. Right... Well... I'm 110% sure that it is Litecoin not LiteCoin, the same way that it is Bitcoin not BitCoin. In fact, it's the same way that Eurodollars are not EuroDollars, so even in that hazy circumstance where the etymological components of the compound word are both indubitably proper nouns... Grammar must prevail. Additionally, the article only references these "cryptocurrencies" which is provided by Wikipedia, and it underestimates the total number of different cryptocoins....