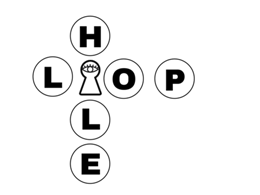

Did the IRS Just Make Bitcoin a New Tax Loophole?

As most people have now heard, the IRS just granted itself the power to tax the gains realized when individuals sell or spend their bitcoins - much like stocks. That means you are also responsible for knowing exactly how much your Bitcoin holdings have increased in dollar terms since you bought them. If you are a miner, it even means all those 1's and 0s....

Related News

Reports from South Africa suggest that tax authorities have plugged a loophole on the online tax filing system that enabled crypto arbitrage traders to make several purchases on overseas cryptocurrency platforms using just one approval. As a consequence of these tweaks, crypto arbitrage traders are now forced to make a new application each they need to place an order. In addition, this change also effectively rules out daily arbitrage trades. Loophole Plugged As the publication Moneyweb’s report explains, some South African crypto traders have been known to “profit from....

Ryan Castellucci, a security researcher at digital fraud firm White Ops, shared that there could be a loophole in which bitcoin passwords can be traced to steal funds. This might be possible through brainwallets, wherein bitcoin passwords are stored in the memory of the user through a long word or phrase that interacts with the blockchain. In particular, the brainwallet password might be traced to the private key, then to the public key, and eventually to the bitcoin wallet address. Castellucci revealed his findings in the DEF CON 23 annual global hacker convention. Traceable Bitcoin....

A loophole in MakerDAO’s collateralized debt market enables positions to be closed far more leniently than intended due to an oversight in the auction process.

Alpha Finance says the "loophole" has been patched.

The U.S. “wash sale rule” gives bitcoin investors the chance to realize tax breaks. Here’s how.