5 Reasons Volatility on Bitcoin Charts Will Decline

Is it almost time to put the bitcoin charts behind us? Price volatility is still the Achilles heel of Bitcoin right now, but the bitcoin charts have been showing a movement towards stability over the past few years. While anyone could move the market with a few hundred dollars in the early days of the cryptocurrency, it now takes a hefty chunk of cash to move the digital asset in one direction or the other. Merchants and mainstream users are still frightened by the idea of entering a young, volatile currency market, which can't really be called anything but practical. It's no secret that....

Related News

Patrick Foot is a writer on financial markets at IG, a leading provider of online trading. In this article he examines what the current lack of volatility in the forex markets means for traders of digital currencies like bitcoin. The last 12 months have been barren for forex investors hoping for some currency movements they can base trading strategies on. Volatility has dwindled from healthy levels in mid-2013 down to 25-year lows in May and July this year. Several reasons have been put forward for what may be the cause of this dry spell, but the overriding causes appear to be the....

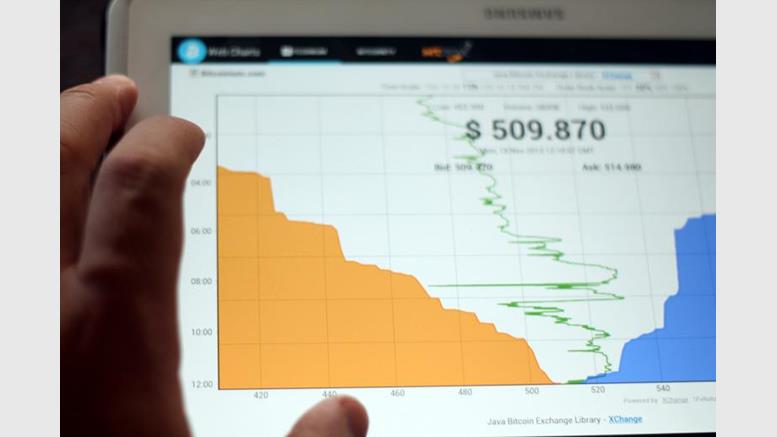

Bitcoin price slammed through several layers of support to hit a previous long-term resistance level at $465. Although the market seems to have found a bottom, there is not yet any technical reason to believe the decline is complete. Now is the time to count your money and sit out of the market for a few days or weeks. The 4-hour and 1-day timeframe charts gave us MA sell signals, and the 3-day chart gave us MACD and stochastic bearish signals. During the overlap of the late US trading session and early Asia-Pacific sessions, bitcoin price was sold to the resistance-turned-support level at....

Dogecoin is by far one of the most popular coins among cryptocurrency fans all over the globe. Since its launch in late 2013, dogecoin has been endorsed by a strong supporting community and innovative marketing efforts. However, a closer look at doge/btc price charts reveals that throughout the majority of 2014, the price of dogecoin has been declining. The price of dogecoin topped up to over 250 satoshis in Febraury, yet it fell down to 50 satoshis in June and since then, it stabilized around 50-60 satoshis. The dogecoin market capital exceeded 80 million US$ early in 2014, but within....

Here's a look at what we are focusing on in the bitcoin price this evening. We’re big advocates of bitcoin (I guess that goes without saying) and so when price moves as part of a steep decline, it hurts a little. We’ve all got holdings, and these holdings take a hit when the bitcoin price dips. That said, when you trade intraday as we do, a decline is neither positive nor negative, it’s just volatility. We like volatility, and we can take advantage of it if we set up right. In this instance, we set up right, and despite price collapsing from the high 700s to where it currently sits....

Weekend trade pulled the Bitcoin price below support at $400. At the start of the European session today, an intraday low was printed across exchange charts - $364.79 at Bitstamp. The new low has made decline to $200 a possibility, but it's unlikely to be achieved in a single wave down. Bitcoin Price Swings. Readers who have found this Bitcoin price analysis article because they are looking for more information about Bitcoin's price volatility should look at the following articles: What Happening with the Bitcoin Price? What Affects the Bitcoin Price? What Determines the Value of Bitcoin?....