Coinbase Names Aon as its Bitcoin Insurance Broker

CoinDesk has reached out to Coinbase for clarification on whether the company's policy excludes bitcoin held in cold storage (offline wallets). Coinbase has revealed that its users' online wallets are being insured through top broker Aon. The news came in a surprise blog post in which the company announced it has been insured against the theft or loss of bitcoin since November 2013, stressing that its users are not being charged for the cover. The wallet and merchant services provider said it teamed up with Aon, one of the world's largest insurance brokers, to further protect its users'....

Related News

In a surprise post on Coinbase's blog today, Coinbase revealed that they have "been insured for almost a year." Coinbase insurance was secured through worldwide insurance broker, Aon. Aon has over 60,000 colleagues worldwide and provides services for clients in over 120 countries. That Coinbase is securing insurance from a potentially worldwide network of underwriters is no small fact to look over. Coinbase's insurance policy "covers losses due to breaches in physical or cyber security and employee theft." Pointedly, Coinbase insurance does not help any individuals that lose their bitcoins....

San Francisco-based Coinbase has published an interesting blog post on Wednesday, which essentially serves a means of comforting its users. In short: the company announced that it holds insurance against both theft and loss of the bitcoin they hold - much of which belongs to its over one million users. Interestingly enough, however, they say that they have been insured since November of 2013, adding that "given the recent claims of insurance in the industry," felt it appropriate to inform its user base. They write: Coinbase is insured against theft and hacking in an amount that exceeds the....

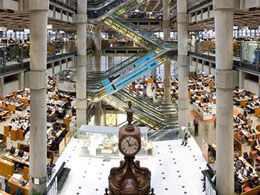

More and more Bitcoin businesses are adopting mainstream practices and seeking insurance for their operations. A report by top insurance market operator Lloyd's, published on June 12 and targeted at insurance service providers, highlights the key risk factors for the insurance of Bitcoin operations. Lloyd's, an insurance market located in London, is one of the best-known names in the insurance sector. It operates as a marketplace within which multiple financial backers come together to pool and spread risk. Lloyd's itself does not underwrite insurance business, leaving that to its members.....

An advisory council to the US Treasury Department focused on the insurance market will discuss blockchain tech at a meeting later this week. Set for tomorrow afternoon in Washington, DC, the Federal Advisory Committee on Insurance (FACI) will discuss a range of issues, according to publicly available materials, including the use of the tech in the US insurance market. The government said of the hearing: “In this meeting, the Committee will discuss a number of issues, including blockchain technology in the insurance sector, the changing auto safety landscape, and an overview of insurance....

FDIC insurance is highly sought-after by crypto exchanges, lenders, and other service providers. Is it the key to mass adoption? Over the years, several cryptocurrency companies have claimed that deposits with them were insured by the United States Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) as if they were regular savings accounts. While so far, no crypto firm has been able to offer depositors this type of insurance, some speculate it could be the key to mass adoption.The most notable case is that of bankrupt lender Voyager Digital, which saw regulators instruct....