Lloyd's Report Analyzes Bitcoin Risks for Insurers

More and more Bitcoin businesses are adopting mainstream practices and seeking insurance for their operations. A report by top insurance market operator Lloyd's, published on June 12 and targeted at insurance service providers, highlights the key risk factors for the insurance of Bitcoin operations. Lloyd's, an insurance market located in London, is one....

Related News

Bitcoin's security risk will "never be reduced to zero", according to a report released by insurance market Lloyd's today. The 31-page document, commissioned to assess the risks involved in insuring bitcoin operations, warns that companies will continue to face a "dynamic threat", regardless of their security practices. Garrick Hileman, an economic historian at London School of Economics (LSE) and one of the report's authors, told CoinDesk that while security in the industry is tightening, systemic issues remain: "The improvements we're seeing in many bitcoin risk areas, particularly at....

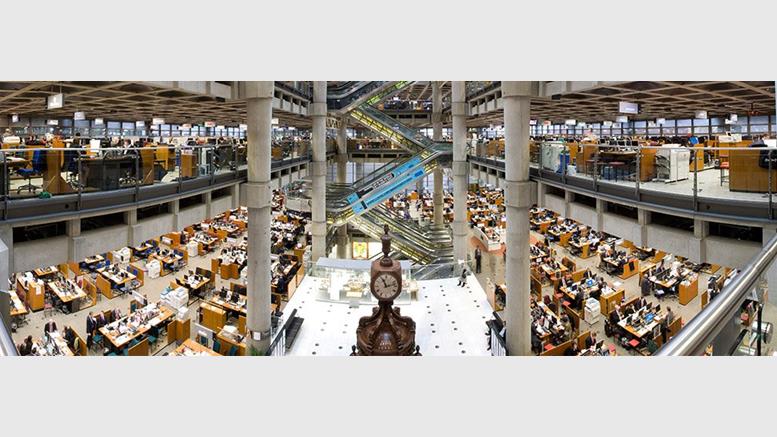

Charles A Cowan is counsel in the Insurance Practice Team within the Corporate & Securities Practice Group at Drinker Biddle & Reath. He previously managed a team responsible for the investigation of internal and external financial crime and regulatory non-compliance at Lloyd's of London. In this article he discusses the risks that influence an insurer's decision to work with companies in bitcoin, and how they might be overcome. In 1904, Lloyd's of London was still largely a marine market. And so, when approached in that year to issue the world's first automobile policy, underwriters did....

The London based insurance giant, Lloyd's has recently published a report on the risk factor associated with Bitcoin and other digital currencies. The report titled "Bitcoin - Risk factors for insurance" provides a detailed description of different kinds of threats faced by Bitcoin. According to the company, the security risk associated with Bitcoin will never be reduced to zero. The Lloyd's report, authored by multiple experts was specially commissioned to understand and assess the risks associated with insuring Bitcoin based businesses. The report shows that the companies involved in....

The relationship between Lloyd's of London and bitcoin storage service Elliptic Vault broke down just weeks after Elliptic's launch in January, it has emerged. Elliptic Vault was the first insured bitcoin storage service in the world and was widely hailed as a milestone for the industry. The exact details of how the relationship between Lloyd's and Elliptic broke down are unclear, with Elliptic COO Tom Robinson saying his impression was that Lloyd's pulled out "due to the high level of publicity" around the deal. In turn, a Lloyd's spokesperson claimed Elliptic never actually finalised the....

A plan to modernise the London Market - the major international insurance market based in the United Kingdom's capital - may include recommendations to use blockchain technology to improve data access and reduce costs associated with administrative paperwork. Lloyd's, one of the London Market's key participants, held a seminar in London last week to highlight blockchains, among other technologies, to insurance market participants as part of their modernisation plan, called the Target Operating Model, or TOM. Blockchains could bring increased risk-recording abilities, transparency, accuracy....