Bitcoin Insurance - Risk Is Always There to Stay

The London based insurance giant, Lloyd's has recently published a report on the risk factor associated with Bitcoin and other digital currencies. The report titled "Bitcoin - Risk factors for insurance" provides a detailed description of different kinds of threats faced by Bitcoin. According to the company, the security risk associated with Bitcoin will never be reduced to zero. The Lloyd's report, authored by multiple experts was specially commissioned to understand and assess the risks associated with insuring Bitcoin based businesses. The report shows that the companies involved in....

Related News

The number of hacking attacks on various companies, irrespective of their business have been on a rise across the world. The increasing frequency and the extent of such attacks have driven the costs of obtaining a cyber insurance cover upwards. The premium for such insurance policies vary from business to business, based on the factor of risk associated with them. Among all the businesses, banking, finance and especially cryptocurrency based businesses are the worst affected due to drastic increase in rates and deductibles. Over that, insurers in some cases are also setting a cap to....

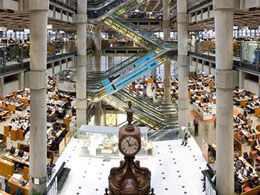

More and more Bitcoin businesses are adopting mainstream practices and seeking insurance for their operations. A report by top insurance market operator Lloyd's, published on June 12 and targeted at insurance service providers, highlights the key risk factors for the insurance of Bitcoin operations. Lloyd's, an insurance market located in London, is one of the best-known names in the insurance sector. It operates as a marketplace within which multiple financial backers come together to pool and spread risk. Lloyd's itself does not underwrite insurance business, leaving that to its members.....

AIG offers Cyber Insurance. American Insurance Group, aka AIG, has announced that it is now offering a new type of insurance policy, one that will compensate companies and individuals, that have suffered losses due to cyber attacks that damage property and harm people. Tracey Alloway, writing from New York Financial Times, reports that this new insurance policy is the first of its kind from a major international insurer and offers a level of cover beyond that previously available. In the past policies were available but they only covered corporate losses arising from data breaches. At the....

This is a guest post by Michael Folkson. The Internet was originally developed as a network for information exchange. Now, a multitude of entrepreneurs and software developers are building the Internet for value exchange. The next logical progression is to build the Internet for risk exchange. Just as units of currency can be transferred to a third party, insurance contracts transfer risk exposures to a third party. Blockchain technology has the potential to radically transform how the insurance industry operates and how risk exposures are shared and distributed. While Bitcoin offers a....

German-based insurance giant Allianz has announced it has been successfully testing Blockchain technology and smart contracts for the processing of default swaps and bonds. The company is feeling positive about the potential of technology to increase the competition among financial institutions. Allianz Risk Transfer, founded in 1997, has been operating as the center of competence for alternative risk transfer business within the Allianz Group offering tailor-made insurance, reinsurance and other non-traditional risk management solutions to industrial and financial clients worldwide.....