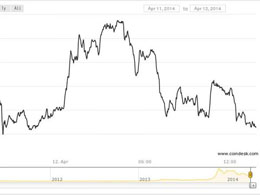

When Might We Expect Bitcoin Price to Bottom?

I think even any remaining sceptics can likely agree with what I have been saying on this page for the last week, i.e., that lower prices were coming before higher prices. Now I would like to try to answer the question of when the most likely time to reach the bottom might be. To do that, I used a Fibonacci accordion to measure time ratios across a 5-hour chart. If any of you do not know what a Fibonacci accordion is, you owe it to yourself to do some research. It is a powerful tool to forecast likely high energy time frames in the future, as well as price support and resistance. IMHO it....

Related News

Tuur Demeester is an economist and investor focused on personal and financial freedom and bitcoin, and editor in chief at Adamant Research. With all the commotion in the market, now is an interesting moment to take a step back and look at some price patterns. I think especially the price behavior of China versus US/EU can be instructive to assess what to expect from the markets going forward. Back in December, based on two previous cycles in bitcoin, I projected a bottom between late February and mid March, from the peak of $1,150 to between $400 and $500. On 24th February, following the....

Crypto analyst Master Ananda has asserted that the bottom is in for the Bitcoin price following its massive crash below $80,000 last week. In line with this, the analyst revealed what to expect next from the flagship crypto. Bitcoin Price Action Shows Bottom Is In In a TradingView post, Master Ananda claimed that the bottom is in based on the current Bitcoin price action. He stated that last week’s drop, touch-and-go, is the perfect bottom signal. The analyst further remarked that $78,300 can be taken as the bottom, which represents a 28% decline from BTC’s all-time high (ATH) of....

Calls for a trip back to $20,000 or even lower were in abundance after Bitcoin collapsed by 50% and sent the market into a bearish state. However, the idea that Bitcoin has bottomed is beginning to broaden. That statement is also a double entendre, referencing a potential chart pattern which further supports the theory. Here is a closer look at the potential broadening wedge bottom pattern, how the recent market conditions fit, and what to expect if the pattern confirms. The Case For The Bottom Being In Begins To Build Bitcoin price collapsed from highs set in Q2 around $65,000 to as low....

Earlier today we published a piece that looked at the overnight action in the bitcoin price and forecasted the likely trail price would take throughout the European session. We had 240 - highs seen earlier on in the day - slated as the initial potential upside target. The European session has now closed, and a look at the bitcoin price on an intraday level vindicates our initial target. Now looking forward, action has offered up yet another opportunity to get in at the bottom of what looks to be a short-term correction, and once again ride BTCUSD towards daily highs. Take a look at the....

Ethereum’s price is again testing the bottom limit of the long-term flat. The beginning of a medium-term trend is therefore likely to grow under these conditions. ETH/USD. As was predicted last week, the large amount of buy stop orders has prevented the price from falling even lower. Instead, Ether’s price is steadily forming a sub-wave of the downward trend. At the moment, ETH has again reached the bottom limit of its long-term flat. There is a pretty large volume near $10. The sentiment of the majority of the bulls hasn’t changed from the beginning of previous week, and they still expect....