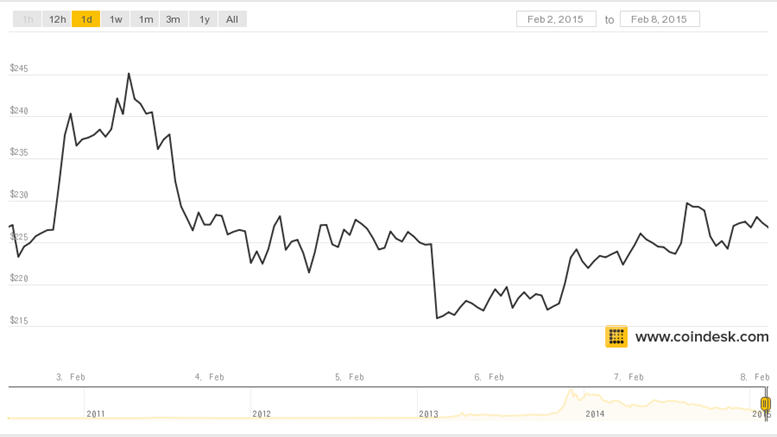

Markets Weekly: Slow Week for Bitcoin Price as 'Grexit' Looms

The bitcoin price stayed relatively flat over the last week, trading around the $225 mark. The digital currency opened on 2nd February at $226.40 and closed seven days later at $222.87, showing a loss of 1.56% over the period, according to the CoinDesk Bitcoin Price Index. Price movement appeared to be muted in the absence of major announcements or events. The first days of the week showed the most action. On 2nd February, the price climbed $16 to hit a high of $242. This was followed by the week's biggest intra-day swing the following day, when the price plunged $22 from a high of....

Related News

After two weeks of sharp, last minute changes in the Bitcoin price, the markets caught a break this week, with the price remaining fairly stable throughout. Thus, it seems as if the speculators have finally settled down. This, combined with this week’s relatively slow news week, explains the sideways action that persisted throughout the week. This week started with the markets coming off the last-minute plunge in the Bitcoin price that occurred last week. Monday opened at $228.18, and returned to the $230s during the morning hours. By midday, the price had leveled out in the low $230s, a....

The Fed's decision on interest rates is due Wednesday — and everyone in Bitcoin is talking about it. Bitcoin (BTC) upped the volatility into the weekly close on March 13 as markets braced for geopolitical and macro economic cues.BTC/USD 1-hour candle chart (Bitstamp). Source: TradingViewLong-awaited Fed action set to come this weekData from Cointelegraph Markets Pro and TradingView followed BTC/USD as it again came close to testing $38,000 support during Sunday.The pair had seen a quiet end to the week on Wall Street, the weekend proving similarly calm as the status quo both within and....

The markets sprang into action this week, with the price rising steadily during a build-up to a massive rally at the end of the week. This price explosion comes while eyes are still glued to global markets, worried about a Chinese slowdown. However, it appears as if some profit taking began at the end of the week, suggesting some possible downward movement in the days to come. October 19, 2015 started our week with the Bitcoin price at $262.90. This Monday saw a slow climb on the markets, reaching a peak of $266.01 at 9 AM, and then hitting a lull in activity that lasted until the night.....

It’s touch and go as to whether BTC can avoid its first four weekly candles in the red since June 2020. Bitcoin (BTC) stayed below $40,000 on April 24 as the weekly close looked set to be a painful one for bulls. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingViewBinance bids slowly thin below spotData from Cointelegraph Markets Pro and TradingView showed BTC/USD failing to retake the $40,000 mark after losing it before the weekend.As traders braced for classic volatility into the weekly close, Bitcoin looked decidedly unappetizing. At $39,500 on Bitstamp, the spot price at the....

Bitcoin ended the previous week on an extremely strong note even as the Greece crisis looms. Since our last discussion Hanging by a Thread, the price has jumped 3.47% to $250.15. A major contribution to Bitcoin's price rise could be of speculators, who are lifting the price higher in the anticipation that a Grexit could result in the adoption of Bitcoin as the Greece's new official currency. So, can Bitcoin head higher or is $250 to big a hurdle to cross? Let us find out via the technical analysis of the 240-minute BTC-USD price chart. Bitcoin Chart Structure - As reports became clear that....