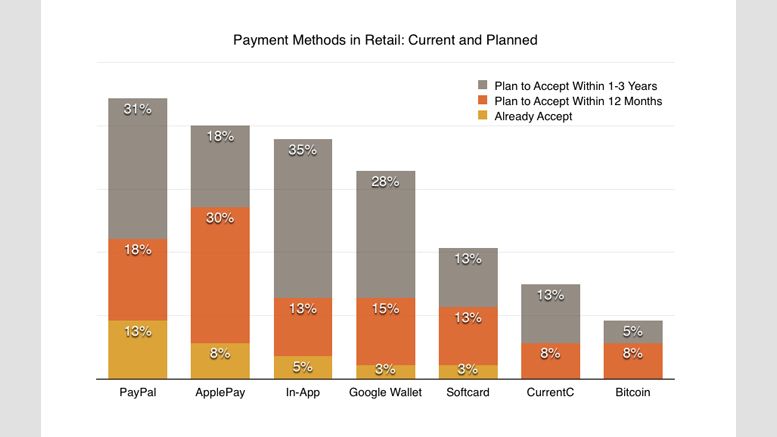

Survey: 8% of US Retailers Plan to Accept Bitcoin in the Next Year

An online survey has found that 8% of US retailers say they are planning to accept bitcoin within the next 12 months. The data, collected by Boston Retail Partners, after surveying 500 retailers across the US, showed that none of the businesses were currently accepting bitcoin, whilst 5% have plans to adopt it within three years. Source: Boston Retail Partners. In contrast, the report found that PayPal was the most widely accepted alternative payment type. The payment processor is already accepted by 13% of those surveyed, whilst 49% plan on adopting it in the next three years. Apple Pay,....

Related News

Apple said in January that 2015 would be “the year of Apple Pay.” A recent Reuters report suggests otherwise, however. According to an interview with retailers, as the payment system is approaching the end of its first year, many don’t see the demand for the platform. Apple’s contactless payment system has gained some traction with financial institutions and merchants, although according to the recent survey the percentage of acceptance is small. Reuters surveyed 98% of retailers from the National Retail Federation’s list of the top 100 U.S retailers. Less than a quarter accept Apple Pay,....

Payments giant Visa has conducted a survey of small businesses and found that almost a quarter of those who responded plan to accept cryptocurrency payments this year. “I think more people are feeling more confident with crypto,” said a Visa executive.

Small Businesses in 9 Countries Plan to Accept Cryptocurrency This Year

Visa published a study on digital payments Wednesday. It was conducted by Wakefield Research in December 2021 and included a survey of 2,250 small business owners with 100 employees or fewer in Brazil, Canada, Germany, Hong Kong, Ireland,....

American multinational banking and financial services holding company JP Morgan Chase & Co. has announced the launch of its own version of a mobile payment system, Chase Pay, which will allow users to pay major retailers and merchants in the U.S, including the country’s largest retailers Walmart and Best Buy. As a rival platform, the bank’s mobile payment network is set to challenge Apple Pay in various strategies. For example, since its launch a year ago, Apple Pay failed to convince major retailers including Walmart and Best Buy to accept payments through its technology. In fact,....

Improving customer experience, increasing the customer base and a hope their brand is perceived as “cutting edge” were the biggest reasons given for a desire to adopt crypto payments. Three quarters of United States retailers plan to accept crypto or stablecoin payments within the next two years according to a new survey. It also found that more than half of large retailers with revenues over $500 million are currently spending $1 million or more building the required infrastructure to make it happen.The information was revealed in Deloitte’s “Merchants Getting Ready For Crypto” report....

UK retailers are exploring alternative payment options and moving away from traditional cash payments due to relatively high costs, according to a new survey compiled by payments provider Sage Pay. The company's research reveals that UK retailers now spend a whopping £17.8bn (almost $30bn) a year just to process cash payments. As a result, they are looking at cheaper alternatives, but it seems most of them are staying away from bitcoin. This general trend is not new. The British Retail Consortium (BRC) has been keeping track of retail transactions for years and the volume of cash....