MGT Capital Investments, Tera Group to Create First Publicly Traded US Bitcoin Derivatives Exchange

MGT Capital Investments announced a planned merger with Tera Group, which operates the first regulated U. S. Bitcoin derivatives exchange. The merger will create the first publicly traded U. S. Bitcoin derivatives exchange. As observed by The Wall Street Journal, this is a reverse merger where Tera will take a controlling stake in MGT. Tera doesn't seem....

Related News

NewBitcoin ATMs in the USA and the UK, youth entrepreneurial program looking to empower under-served populations with Bitcoin, MGT Capital Investments to merge with Tera Group and launch the first publicly traded American Bitcoin derivatives exchange, and more top news to wrap up the week. MGT Capital Investments announced on February 26, it has enter into a Letter of Intent with Tera Group, Inc., the owner of TeraExchange, LLC, a Swap Execution Facility regulated by the US Commodity Futures Trading Commission (CFTC). Both companies are looking to come to a definitive agreement by March....

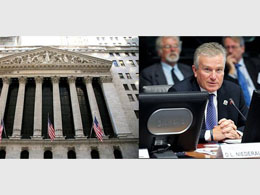

A few weeks ago Bitcoin Magazine reported that Tera Group, which operates the first regulated U. S. Bitcoin derivatives exchange, will take a controlling stake in public company MGT Capital Investment to create the first publicly traded U. S. Bitcoin derivatives exchange. On Monday, Tera Group announced the appointment of former New York Stock Exchange (NYSE) CEO Duncan Niederauer as an advisory director. Before joining NYSE in 2007, Niederauer was managing director and co-head of the Equities Division Execution Services franchise at Goldman Sachs. "This is an excellent opportunity to....

Tera Group Inc, the operator of the US's first regulated Bitcoin derivative platform Tera Exchange, recently signed a merger agreement with MGT Capital Investment; thereby adding a crucial step that should make the former a publicly listed company. According to the available details, both the parties have currently agreed on some "contemplated" terms of the agreement which will reach its conclusion by March 16th, 2015. But as per now, it is definite that Tera will have a major stake in MGT's common stock shares (at least 70%). From the look of it, Tera however seems to be disinterested....

Digital economy startup Digital Asset Holdings will allow its clients to trade financial assets using bitcoin as operating currency for cheaper, faster and fully traceable transactions, Financial Times reports. Former JPMorgan Chase & Co. executive Blythe Masters will be the CEO of the new company, overseeing employees in New York, Chicago and Tel Aviv. This latest episode of the ongoing love story between Bitcoin and Wall Street follows a wave of announcements of new publicly traded Bitcoin financial products. Recently, Barry Silbert's Bitcoin Investment Trust became the first publicly....

Tera Group, a bitcoin derivatives platform, recently announced that former New York Stock Exchange (NYSE) CEO Duncan Niederauer will be joining their firm as an Advisory Director. The firm has already gained approval from the Commodity Futures Trading Commission (CFTC), which is a financial regulatory agency in the United States, for its trading platform but the bitcoin derivatives have yet to gain accreditation. Tera Group has also entered a reverse merger agreement with MGT Capital, allowing the company to go public. However, the final terms of the agreement are still being discussed,....