More Wall Street Insiders Move Into Bitcoin: Tera Group Hires Former NYSE CEO

A few weeks ago Bitcoin Magazine reported that Tera Group, which operates the first regulated U. S. Bitcoin derivatives exchange, will take a controlling stake in public company MGT Capital Investment to create the first publicly traded U. S. Bitcoin derivatives exchange. On Monday, Tera Group announced the appointment of former New York Stock Exchange....

Related News

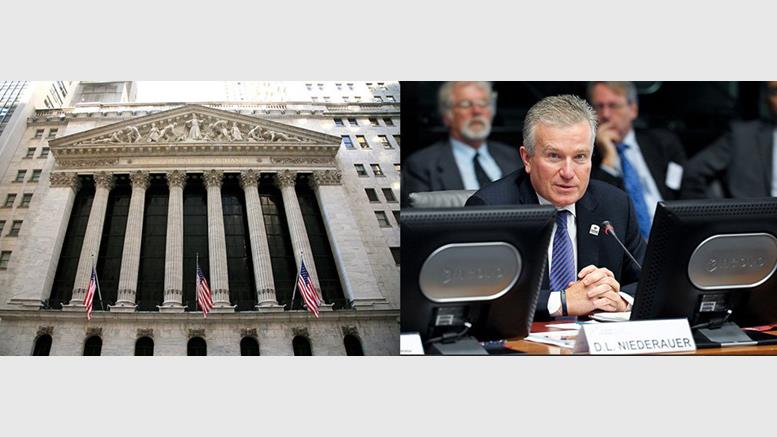

Tera Group, a bitcoin derivatives platform, recently announced that former New York Stock Exchange (NYSE) CEO Duncan Niederauer will be joining their firm as an Advisory Director. The firm has already gained approval from the Commodity Futures Trading Commission (CFTC), which is a financial regulatory agency in the United States, for its trading platform but the bitcoin derivatives have yet to gain accreditation. Tera Group has also entered a reverse merger agreement with MGT Capital, allowing the company to go public. However, the final terms of the agreement are still being discussed,....

MGT Capital Investments announced a planned merger with Tera Group, which operates the first regulated U. S. Bitcoin derivatives exchange. The merger will create the first publicly traded U. S. Bitcoin derivatives exchange. As observed by The Wall Street Journal, this is a reverse merger where Tera will take a controlling stake in MGT. Tera doesn't seem too interested in MGT's gaming operations, so the operation is primarily a way for Tera to go public. In other words, Tera is buying a public listing on the stock market for its Bitcoin operations. Tera has played a leading role in the....

Despite the rocky times that bitcoin has been undergoing in the past months, big financial institutions in Wall Street, namely the NYSE, Goldman Sachs, and Fortress Investment Group continue to believe in the cryptocurrency. These companies have explored bitcoin ventures and have investment in the underlying technology called blockchain. In particular, Fortress is invested in the actual cryptocurrency and in a hedge fund that backs companies that focus on building tools for bitcoin. NYSE is invested in Coinbase, which is a large bitcoin wallet and exchange based in San Francisco.....

Wall Street has been embracing the latest wave of Silicon Valley financial tech at a fast rate. Over the past several months, many Wall Street Financial companies have embraced the new wave fintech enterprises with remarkable speed. The blockchain an online ledger that tracks the movement of digital currency, but it can also be used to manage, register and secure anything else that has value. Wall Street companies seem to have seen the true potential of the blockchain technology and many are now rushing to invest and develop new applications with this new technology. Jamie Dimon, JP Morgan....

Wall Street is often touted as the place where dreams come to life, but the world’s economic epicenter can also be an absolute nightmare. From brokers screaming at each other across trading floors to the modern electronic trading systems of today, money talks in Wall Street. However, while the NYSE houses over $28.5 trillion in assets, there’s still a lot left unsaid.

On Wall Street, it is believed that history doesn’t repeat itself, but rhymes. The world’s financial systems have failed consistently over time, but when Phemex’s founder Jack Tao....