MegaBigPower Opens Buyback for Unprofitable Bitcoin Miners

MegaBigPower has announced that it will begin purchasing preowned bitcoin mining ASICs as part of a plan to acquire as much as 10 megawatts worth of hardware. Under the buyback program, the US-based bitcoin mining company will purchase certain types of hardware, with an emphasis on models sold by mining manufacturers Spondoolies-Tech and Bitmain. Founder Dave Carlson framed the program as a simpler alternative for miners looking to sell their equipment online, telling CoinDesk: "Due to our extremely low power cost, we can still return funds to miners who may have gotten in just before the....

Related News

The US-based Bitcoin mining giant MegaBigPower has announced on its official website (www.megabigpower.com) that it will launch a buyback program where unprofitable Bitcoin miners can sell their hardware. The company plans to boost its mining power by as much as 10 megawatts by buying pre-owned ASICs. Under the buyback program, the manufacturer of cutting edge mining hardware will be particularly interested in models sold by mining manufacturers Spondoolies-Tech and Bitmain. The buyback was a simple alternative for the miners who were struggling to make profits in the extremely competitive....

Industrial bitcoin mining company MegaBigPower has announced that it is starting a franchise program that could reshape the bitcoin mining network and create new pathways for industrial mines to form. The program enables individuals or companies that want to start a mine to step around a critical roadblock: mining hardware startup costs. MegaBigPower aims to provide mine operators with the know-how to begin hashing quickly, accomplishing this by providing pre-configured hardware at no upfront cost to vetted candidates who are capable of providing facilities and power. Washington-based....

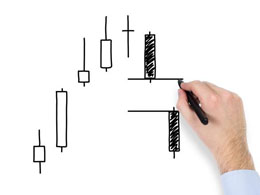

Bitcoin derivatives startup Hedgy has raised $1.2m in new seed funding from a group of 10 investors that includes Draper Fisher Jurvetson partner Tim Draper, Salesforce CEO Marc Benioff and Sand Hill Ventures. In conjunction with the announcement, Hedgy has also launched a new derivatives product aimed at commercial bitcoin miners. Miners that use the derivative can effectively lock in a future price at which they can sell bitcoins, using a smart contract to settle the transaction on the bitcoin blockchain. Drawing price metrics from TradeBlock, the new product is the result of a....

PRESS RELEASE. Nexo, the leading regulated digital financial institution with over $2 billion in assets under management, today announced the details of its buyback program. The company’s Board of Directors approved an initial repurchase of $12 million of its NEXO Token on an open-market principle, with the decision coming into force with immediate effect. Part of the company’s recently launched tokenomics overhaul Nexonomics, the move seeks to further boost the value of the NEXO Token, which marked a 160% price increase since the campaign’s launch in late October. The....

Data shows the Bitcoin miner “hashprice” has fallen towards all-time lows, a sign that these chain validators could be coming under pressure. Bitcoin Miners Are On The Brink Of Becoming Unprofitable In its latest weekly report, the on-chain analytics firm Glassnode has looked into some miner-related metrics to see how they are doing in terms […]