Securities Blockchain Will Have Limited Cost Savings – Ripple MD

Financial institutions have invested significantly in the development of Blockchain technology. However, the Asia Pacific MD of Ripple feels that cost savings are not expected to be significant in the securities market. Dilip Rao at the 2016 AFR Banking & Wealth Summit says: “Where blockchain has had the most impact is where there are a number of networks, but they don't talk to each other very well. There is no obvious trust between these networks, a central authority.” According to Mr Rao, cost savings are likely to be less where there is a homogeneous network with a central....

Related News

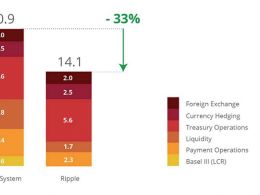

Ripple has projected that banks that use the Ripple network and its native cryptographic token XRP for cross-border payments can save up to 42% when compared against today's options. The findings are part of a new 15-page report issued today by the distributed ledger technology (DLT) startup. Entitled “The Cost-Cutting Case for Banks”, it finds Ripple offering clarity as to the cost-savings its products can realize for the first time. Further, the report projects respondent banks using Ripple without XRP can save 33% on international payments, with savings being generated by a 65%....

San Francisco-based decentralized payment network provider Ripple Labs has announced that German Internet direct bank Fidor is now using the Ripple protocol as part of its transaction infrastructure. With the announcement, Fidor has become the first bank to integrate Ripple's payment protocol, allowing its customers to instantly send money in any currency in any amount through the bank's money transfer products at a lower cost. The move is significant as it will allow Ripple to showcase how its unique open-source approach to payments can be used by banks to replace many of the common....

Nearly nine months after the New York State Department of Financial Services (NYDFS) issued its first BitLicense, it has awarded a second to distributed ledger startup Ripple. The BitLicense approval, effective today, allows the startup to sell and custody XRP, the native asset that powers its Ripple consensus ledger (RCL). While not a blockchain in the strict sense, the tool leverages a digital asset to account for payment information in a similar manner as other token-based blockchain systems such as Ethereum and bitcoin. Founded in 2012, Ripple has succeeded in gaining more enterprise....

In a significant development in the legal battle between Ripple and the Securities and Exchange Commission (SEC), Judge Analisa Torres has rejected the SEC’s motion to appeal the Ripple ruling. This decision comes as another win for Ripple, the blockchain payment company, as it fights allegations of conducting an unregistered securities offering. Judge Rejects SEC’s […]

Ripple has filed a Freedom of Information Act request with the SEC which targets documents pertaining to Ethereum co-founders Ripple's case before the Securities and Exchange Commission is threatening to have major, well, ripple effects for the industry.On Jan. 29, Ripple Labs filed its response to the SEC's complaint. Ripple, as it has many times before, argued that XRP is not a security i.e. an investment in Ripple and is therefore not in the SEC's jurisdiction. Ripple is, moreover, prepared to drag the rest of the industry into its fight to make its case. A Ripple representative told....