Ether Prices Plunge 50% as Bitcoin Stays in Holding Pattern

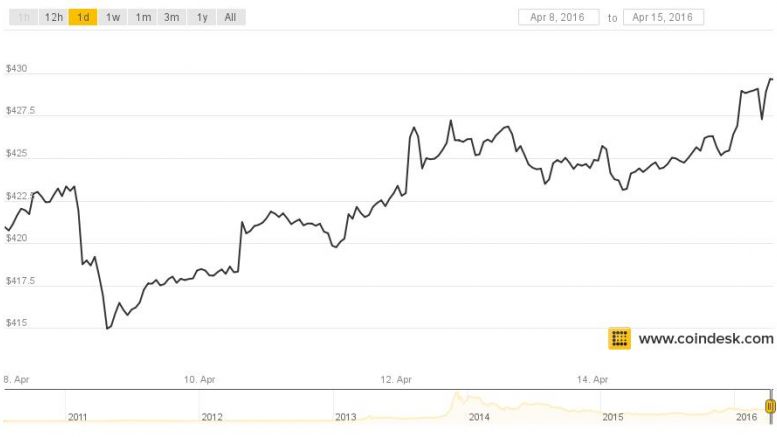

Bitcoin prices fluctuated largely within a tight range between $415 and $425 during the seven days ending 15th April, while the value of ether, the native token on the Ethereum blockchain, declined sharply after weeks of advances. Bitcoin's lack of volatility largely mirrored the last several weeks, when the digital currency was stable across international markets. This stability again took place amid modest volume, as market participants traded just over 11m BTC during the seven days through 9:45 EST on 15th April, according to figures from Bitcoinity. Transaction volume was similar....

Related News

The number of Ethereum addresses holding less than 0.01 ETH and 0.1 ETH has been climbing since early November against an ongoing price correction. Ethereum's native token Ether (ETH) has dropped by over 18% after establishing an all-time high around $4,867 on Nov. 10, now trading near $3,900. Nonetheless, the plunge has not deterred retail investors from buying the token in small quantities.According to data gathered by Glassnode — a blockchain analytics platform, the number of Ether addresses holding less than or equal to 0.01 ETH reached a record high level of 19.95 million on Dec. 4,....

Ether (ETH) prices struck a seven-month low on 2nd December, extending the losses suffered earlier in the week. ETH fell to as little as $7.60 at 15:55 UTC, according to Poloniex figures. The last time the price dropped to this level was in late April. The price of ether – the cryptocurrency of the ethereum network – managed to recover later in the session, reaching $7.88 at 17:10 UTC, additional Poloniex data reveals. In spite of this improvement, ETH followed a steady, downward movement during the day, peaking when it opened the session at $8.40. Ether prices have been encountering....

The bitcoin price is ready to fall. After a large sideways lateral market, prices are about to dive to $600, where a new cycle is expected to start, ultimately resulting with a rebound to $820. Bitcoin Price Heading South, Preparing for Rebound Into New Bull Pattern. Prices are still moving in a lateral pattern, sustaining the $680 level that is persisting at press time. This situation is about to end, though, with a bear movement that should test the support in the $600 zone. The main pattern that has recovered this level, which was originally lost in 2014, is over. Another cycle is....

The Ethereum whale investors have maintained an influence on ETH price. This is because they use their holdings to create their desired trend in the ETH market. But their impact is raising more brows as per the data from CryptoQuant. In the crypto space, the whales are persons or entities with higher investment holding of a particular asset. Holding a significant amount of cryptocurrency makes it easy for whales to manipulate and influence the crypto price. Over time, the perception has always been that the whales project negative influences on the market. This is because they always take....

The bearish setup appears amid growing divergence between the Ether price and momentum. Ethereum's native token Ether (ETH) reached an all-time high around $4,867 earlier in November, only to plunge by nearly 20% a month later on rising profit-taking sentiment. And now, as the ETH price holds $4,000 as a key support level, risks of further selloffs are emerging in the form of multiple technical and fundamental indicators.ETH price rising wedgeFirst, Ether appears to have been breaking out of "rising wedge," a bearish reversal pattern that emerges when the price trends upward inside a range....