Bitcoin Price Analysis (Week of May 15th)

A medium-term flat, which has formed on Bitcoin is a result of the price’s reaction to the long-term level of $450. We’ll be able to determine which side of the market holds the advantage by looking at an impulse, which is expected to happen at one of the limits of this sideway movement. When will the flat end? As long as Bitcoin’s price stays between two significant levels, the flat will continue. Such movement is usually a sort of balance between the bears and the bulls. A flat always forms between two levels which are responsible for the future trend. There was no turn to decline on the....

Related News

This week has been interesting has been full of surprises to say the least. From January 13th to January 15th Bitcoin dropped from a weight priced of 264.35 on Bitstamp to a weighted price of 178.83 exactly 48 hours later. Equivalent to around a 32.4% drop in price in only just two days, it was a reminder that Bitcoin is still a young and volatile currency. While the price has gone back up a little bit (price of Bitcoin is at $210.58), Bitcoin is still down 22.21% this week, as of January 18th. Most if not all cryptocurrencies went down with the main exception being Nushares, which is up....

The price of bitcoin tested resistance at $460 over the weekend ending 15th May, but failed to break through what could prove to be a key level going forward. Overall, the digital currency’s price fluctuated close to $460, a figure which has not been surpassed since 10th May, reaching as much as $458.87 on Sunday, 15th May, according to the CoinDesk USD Bitcoin Price Index (BPI). Further, a series of near misses in attempts to build momentum above this mark suggests that $460 could become a key benchmark for the price moving forward. For instance, bitcoin's price opened at $455.75 on 15th....

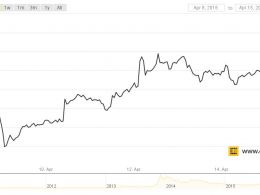

After a spike down to 1.00 last week, litecoin has been drifting lower. The 1H chart shows the cryptocurrency “chewing up” the tail made by the spike. Litecoin (LTCUSD) 1H Chart April 15. Here are some observations on the 1H chart:1) Price action and the 200-, 100-, and 50-hour simple moving averages reflect a persistent bearish market. 2) The RSI has been tagging below 30 and holding under 60, which reflects persistent bearish momentum. That is, until the April 15th session. During the April 15th session, ltcusd found support at 1.32. It formed an intrasession double bottom and price....

Yesterday, bitcoin price ranged between $235.5 and $239.33. Although bitcoin has been trading between $235 and $240 throughout the past few days, it seems that we will see it break out of this range soon. By studying the 1 hour Bitfinex (BTC/USD) charts from tradingview.com, drawing a trend line between the low reached on the 10th of February ($214) and the high reached on the 15th of February ($268) and plotting the Fibonacci retracement levels accordingly (look at the below chart), we can better understand the current market trends and we can also conclude the following: As shown by the....

Bitcoin prices fluctuated largely within a tight range between $415 and $425 during the seven days ending 15th April, while the value of ether, the native token on the Ethereum blockchain, declined sharply after weeks of advances. Bitcoin's lack of volatility largely mirrored the last several weeks, when the digital currency was stable across international markets. This stability again took place amid modest volume, as market participants traded just over 11m BTC during the seven days through 9:45 EST on 15th April, according to figures from Bitcoinity. Transaction volume was similar....