First Ether ETF Filed With the SEC is Not Offering Insurance

As competition heats up amongst Bitcoin ETF providers SolidX and the Winklevoss Twins, another contender emerged to establish an exchange-traded fund based on a digital currency. Recently found company called EtherIndex LLC officially filed with the Securities and Exchange Commission on July 15 to offer the public and conventional investors opportunities to invest in Ether, the underlying currency of smart contract-based decentralized platform known as Ethereum. Similar to existing public digital asset trade and investment tools such as Grayscale Investments’ Bitcoin Investment Trust and....

Related News

Polkacover, the ingenious platform that bridges the gap between traditional insurance companies and crypto-insurance products has just launched its Demo Decentralized Application, demonstrating how users can connect with several insurance providers offering global insurance products such as crypto-related protection, health, life, and more, with ease. Polkacover is the first decentralized insurance marketplace for the DeFi […]

AIG offers Cyber Insurance. American Insurance Group, aka AIG, has announced that it is now offering a new type of insurance policy, one that will compensate companies and individuals, that have suffered losses due to cyber attacks that damage property and harm people. Tracey Alloway, writing from New York Financial Times, reports that this new insurance policy is the first of its kind from a major international insurer and offers a level of cover beyond that previously available. In the past policies were available but they only covered corporate losses arising from data breaches. At the....

Ripple has filed a Freedom of Information Act request with the SEC which targets documents pertaining to Ethereum co-founders Ripple's case before the Securities and Exchange Commission is threatening to have major, well, ripple effects for the industry.On Jan. 29, Ripple Labs filed its response to the SEC's complaint. Ripple, as it has many times before, argued that XRP is not a security i.e. an investment in Ripple and is therefore not in the SEC's jurisdiction. Ripple is, moreover, prepared to drag the rest of the industry into its fight to make its case. A Ripple representative told....

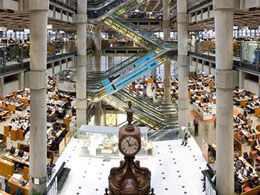

More and more Bitcoin businesses are adopting mainstream practices and seeking insurance for their operations. A report by top insurance market operator Lloyd's, published on June 12 and targeted at insurance service providers, highlights the key risk factors for the insurance of Bitcoin operations. Lloyd's, an insurance market located in London, is one of the best-known names in the insurance sector. It operates as a marketplace within which multiple financial backers come together to pool and spread risk. Lloyd's itself does not underwrite insurance business, leaving that to its members.....

An advisory council to the US Treasury Department focused on the insurance market will discuss blockchain tech at a meeting later this week. Set for tomorrow afternoon in Washington, DC, the Federal Advisory Committee on Insurance (FACI) will discuss a range of issues, according to publicly available materials, including the use of the tech in the US insurance market. The government said of the hearing: “In this meeting, the Committee will discuss a number of issues, including blockchain technology in the insurance sector, the changing auto safety landscape, and an overview of insurance....