Cash Inflow In Emerging Markets Can Be Positive For Bitcoin

Jamie Anderson, a managing principal at Tierra Funds, seems convinced there is data showing these countries are recovering. At the same time, these inflows are only a drop of water on the boiling plate at this stage. For those people who were dreaming of a cashless future, that situation will not become a reality anytime soon. Emerging markets are suddenly receiving bucketloads of cash, to buy stocks and bonds. Interestingly enough, both emerging markets and developing countries are reaping the benefits of this change. It has to be said, a record amount of cash funds have been flowing to....

Related News

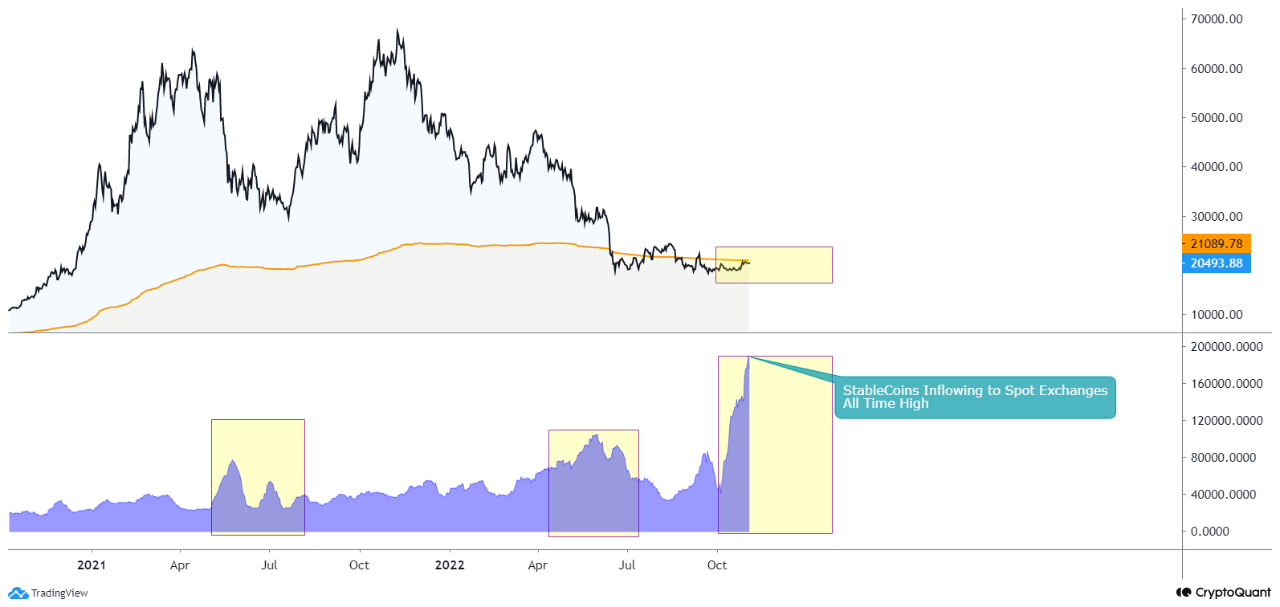

On-chain data shows the stablecoin exchange inflow mean has reached a new all-time high, here’s why this might prove to be bullish for Bitcoin. Stablecoin Exchange Inflow Mean Has Surged Up To A New ATH Recently As pointed out by an analyst in a CryptoQuant post, these inflows can be positive for Bitcoin in the long term, but might be bearish in the short term. The “stablecoin exchange inflow mean” is an indicator that measures the average amount of stablecoins per transaction going into the wallets of centralized exchanges. As stablecoins are relatively stable in value....

On Dec. 21, the European Commission tightened controls on the inflow of cash and precious metals from outside of the EU. Describing its decision as a move to crackdown on terrorist financing, the Commission granted permission to border patrols to seize cash or gold brought in by suspects. Customs officials in EU states, as well as border controls, can seize and restrict the inflow of cash and precious metals without particular guidelines as to whom is suspected of terrorist financing or funding of militant attacks. Such ambiguity in the new proposals could potentially lead to the false....

Ethereum, the second largest cryptocurrency asset, is currently in the limelight as crypto investors have recently demonstrated their renewed interest in and adoption of the historical Spot Ethereum Exchange-Traded Funds (ETFs). Millions of dollars were seen flowing into the products after the market concluded on Wednesday. The inflow is considered a bullish indication for ETH, […]

On-chain analysis shows that crypto exchange Gemini observed huge Bitcoin inflows just before the plunge down to $38k. Huge Bitcoin Inflows To Gemini As pointed out by a CryptoQuant post, crypto exchange Gemini saw huge inflows earlier today resulting in a positive spike in the netflows. Before examining the data, here are some quick definitions for the relevant terms. The exchange inflow is the amount of BTC sent from personal wallets to the exchange platform. Similarly, the outflow is the BTC that was transferred out of exchanges to personal wallets. The netflow is just the difference....

After growing in Latin America, the firm wants to bring its micro-loans and stablecoin savings features to other emerging markets.