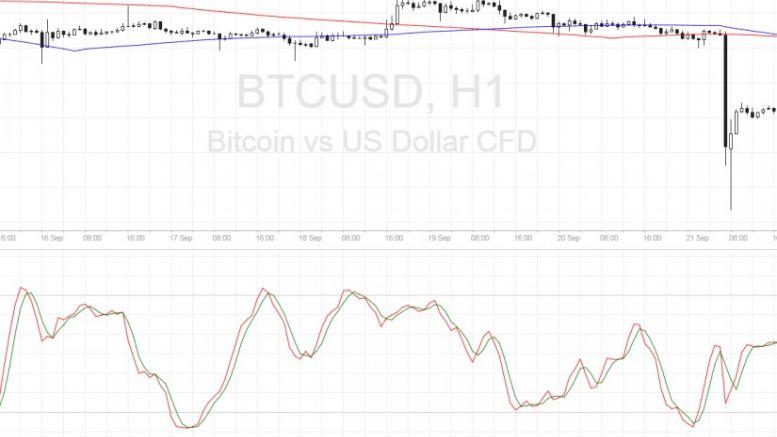

Bitcoin Price Technical Analysis for 09/22/2016 – Selloff Continuation Due?

Bitcoin price looks ready continue is dive on a break of this bearish continuation pattern, with technicals signaling further declines. Bitcoin Price Key Highlights. Bitcoin price recently made a sharp break below a short-term consolidation pattern, which means that sellers have taken control. Price seems to have formed a bearish continuation signal as more sellers could take it down. Technical indicators are also confirming that selling pressure is mounting. Technical Indicators Signals. The 100 SMA is moving below the longer-term 200 SMA, confirming that the path of least resistance is....

Related News

Bitcoin price is hovering at the resistance of the short-term descending channel and could be in for a continuation or reversal. Bitcoin Price Key Highlights. Bitcoin price seems to be establishing a downtrend now that it’s forming a descending channel on its 1-hour time frame. Price is now testing the channel resistance, still deciding whether to make a bounce or a break. Technical indicators seem to be indicating that the selloff could resume but there are also potential arguments for a reversal. Technical Indicators Signals. The 100 SMA is below the longer-term 200 SMA so the path of....

Bitcoin price is testing a long-term support area, with technical indicators hinting at a continuation of the climb. Bitcoin Price Key Highlights. Bitcoin price is in the middle of a sharp selloff but it seems to have found support at the rising trend line as predicted in the previous post. Price spiked off the $500 level, as plenty of buy orders were likely waiting in that area of interest, which held as resistance in the past. Technical indicators seem to be suggesting that the longer-term climb could resume from here. Technical Indicators Signals. The 100 SMA is above the longer-term....

Bitcoin price made a break of the short-term trend line support, signaling a potential selloff from here. Bitcoin Price Key Highlights. Bitcoin price had been moving above an ascending trend line on its 1-hour time frame. Price just made a downside break of support as risk aversion seems to be back in the financial markets. This could be an early signal of a pending selloff, although technical indicators are still giving mixed signs. Technical Indicators Signals. The 100 SMA is starting to cross above the longer-term 200 SMA, which suggests potentially stronger buying pressure. If so,....

Bitcoin price could be due for a quick selloff at this point, as profit-taking might happen ahead of the weekend and next week’s EU referendum. Bitcoin Price Key Highlights. Bitcoin price has been on a tear these days but some technical indicators are hinting at an exhaustion. Price is closing in on the $800 level, which is an area of interest visible on longer-term time frames. If a selloff is seen at the current levels, it could find nearby support at $700. Technical Indicators Signals. The 100 SMA is above the 200 SMA for now so the path of least resistance is to the upside. In....

Bitcoin price could be in for another round of volatile action at the end of this month and quarter. Bitcoin Price Key Highlights. Bitcoin price has consolidated after its strong rally and correction in the past month. But with the end of the month AND quarter upon us, there’s a strong chance that traders would book profits off their recent positions. At the moment, bitcoin price appears to be showing a bearish flag pattern, which is typically considered a selloff continuation signal. Technical Indicators Signals. On the daily time frame, it can be seen that bitcoin price is still in the....