As US Citizens Pay $4.7 Bln Just to Maintain Accounts, Bitcoin Wallets Offer Alternative

With negative interest rates becoming a trend in most countries and inflation rates rising, bank services are not a viable and practical option for storing money. US-based consumers are faced with substantially high overdraft as well as monthly ATM and NSF fees. Millions of Americans pay over $4.7 bln annually, at $30 a month per account, to keep bank and checking accounts open. Most banks in the US charge users $50 to open an account, $30 to leave an account open and $35 in NSF fees. For an average American consumer to have an account open for an entire year, it would cost at least $410.....

Related News

Celsius has motioned for $50 million worth of the total $225 million held in the Custody Program and Withhold Accounts to be released to owners. Beleaguered crypto lender Celsius Network has filed a motion with the United States Bankruptcy Court yesterday to allow customers with digital assets held in certain accounts to be withdrawn. There’s a catch, however, as the motion will only apply to Custody and Withold Accounts and for custodied assets worth $7,575 or less in value. Celsius has structured their Custody and Withhold Accounts, which essentially serve as storage wallets, in a way....

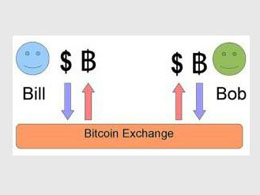

In a managed online wallet, everything is controlled by the wallet's provider. You have an account with the provider with a username and password, much like an email account or an internet forum account, and you can log onto your account and send and receive bitcoins from any computer that has internet access. Generally, these services do not maintain separate wallets for separate users behind the scenes; they are more like banks in the way that all the money is pooled together and they just keep track of how much belongs to whom. The most prominent of these wallets are actually bitcoin....

Venezuela says it will incorporate bitcoin and litecoin wallets to its Patria’s Cryptocurrency Remittance Platform. In an update, authorities in the country say this move will enable Venezuelan citizens to formally receive remittances in cryptocurrency form. Many citizens of hyperinflation hit Venezuela already use bitcoin as a store of value as well as for cross border payments. Plans of Adding Bitcoin-Petro Trading Pairs The formal incorporation of bitcoin into the national remittances system will likely boost the use of cryptos by Venezuelans. The country already ranks third on....

A new deal with NCR and NYDIG has opened up a way for banks across the U.S. to offer Bitcoin buying options to their customers. Forbes reported that the deal would enable community banks including North Carolina-based First Citizens Bank and credit unions including Bay Federal Credit Union in California would be able to offer […]

Argentina’s businesses are adopting crypto cards as an alternative payment choice. After analyzing an increased circulation of cryptocurrency in South American countries, many wallets establish agreements with famous entities like Mastercard and offer attractive benefits to customers. Since last year, only three companies have promoted the crypto cards facilities; Belo became the third company by […]