French Central Bank Conducts an “Interbank Blockchain Experiment”

The Banque de France, the country’s central bank, has revealed details about a discreet blockchain experiment that was put to the test back in October 2016. In a release [PDF] late last week, the bank revealed that it had tested blockchain technology to understand the consequences of decentralizing ledger managing functions of SEPA credit Identifier, which is essentially a simplification of cross-border Euro transfers within the Single Euro Payments Area (SEPA). The experiment was conducted in partnership with Parisian Fintech startup Labo Blockchain as well as the Caisse des Dépôts et....

Related News

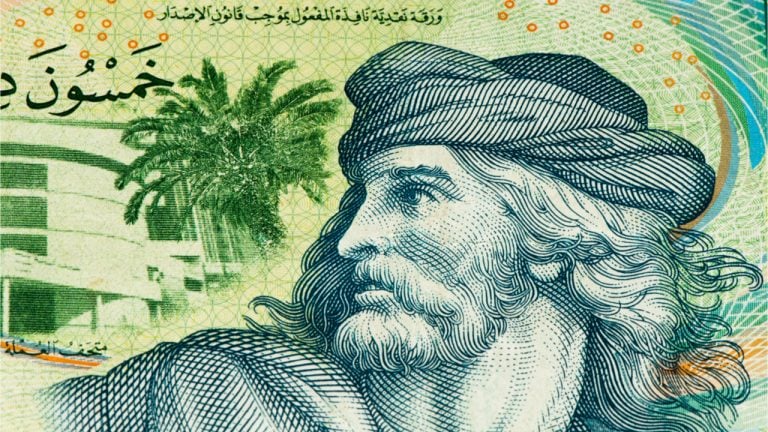

The French central bank, Banque de France (BOF), recently carried out its fifth experiment on the Central Bank of Tunisia (CBT)’s central bank digital currency (CBDC). According to a statement from BOF, the latest experiment is part of the banks’ joint effort to create conditions that are “conducive to a better inclusion of the Tunisian diaspora in Europe.” Platform Targets Tunisian Diaspora In his comments following the experiment, Mohamed Sadraoui, a director-general at CBT, suggested that the CBDC platform’s success will likely “reinforce....

The Banque de France has revealed that it is opening a blockchain innovation lab as it seeks to work more with blockchain startups. In a speech [PDF] presented by Banque de France governor Villeroy de Galhau last month at the Paris FinTech Forum, and published recently, the central bank explained that more work needs to be done with the blockchain. According to Galhau, ‘the digital revolution is creating challenges but also incredible opportunities that are just waiting to be seized, whether by FinTechs themselves, by the entire financial system or by the French and European economy as a....

France’s central bank quietly released new details about its work with blockchain last week. The Banque de France said on Friday that it had tested the tech for hypothetical use in the management of SEPA Credit Identifiers, or identification markers used to establish the identity of creditors within the Single Euro Payments Area. The trial marks its first publicly acknowledged blockchain trial. According to the central bank, one of the key participants in the trial was the Caisse des Dépôts et Consignations, a public-sector organization that acts as a kind of investor on behalf of the....

A French parliament member has signed a petition to amend the laws to enable the central bank of France to buy and hold bitcoin as well as other cryptocurrencies. The petition urges lawmakers to urgently consider the matter, warning that not owning bitcoin will put France “in a financially weak position within 5-10 years.” Petition to Allow Central Bank to Buy Bitcoin Jean-Michel Mis, a member of the French National Assembly, the lower house of parliament, announced in a tweet Friday that he has signed a petition to amend the laws to enable the Banque de France, the....

Led by Belgian financial services firm Euroclear, the latest French CBDC trial involved a system by tech giant IBM. The central bank of France continues actively exploring a central bank digital currency (CBDC), completing a significant trial of a blockchain-based CBDC in the country’s debt market.Over 500 institutions in France have participated in a 10-month experiment testing a CBDC issued by Banque de France for government bond deals, The Financial Times reported Oct. 19.The CBDC trial was led by Belgium-based financial services firm Euroclear and used a system developed by American....