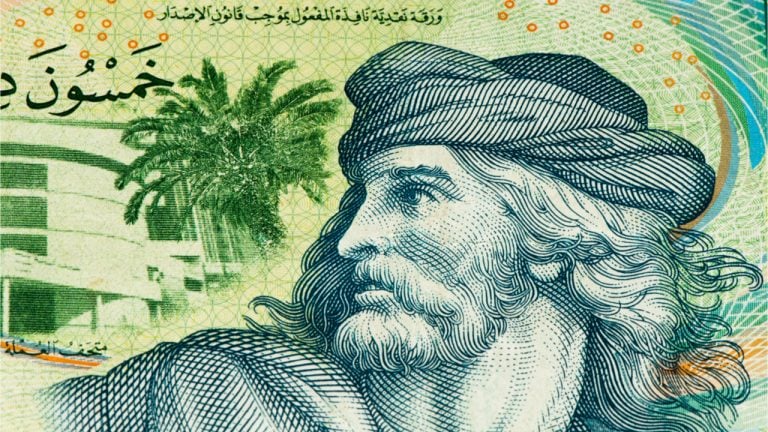

French Central Bank Conducts Fifth Experiment on Tunisia CBDC

The French central bank, Banque de France (BOF), recently carried out its fifth experiment on the Central Bank of Tunisia (CBT)’s central bank digital currency (CBDC). According to a statement from BOF, the latest experiment is part of the banks’ joint effort to create conditions that are “conducive to a better inclusion of the Tunisian diaspora in Europe.” Platform Targets Tunisian Diaspora In his comments following the experiment, Mohamed Sadraoui, a director-general at CBT, suggested that the CBDC platform’s success will likely “reinforce....

Related News

The Banque de France, the country’s central bank, has revealed details about a discreet blockchain experiment that was put to the test back in October 2016. In a release [PDF] late last week, the bank revealed that it had tested blockchain technology to understand the consequences of decentralizing ledger managing functions of SEPA credit Identifier, which is essentially a simplification of cross-border Euro transfers within the Single Euro Payments Area (SEPA). The experiment was conducted in partnership with Parisian Fintech startup Labo Blockchain as well as the Caisse des Dépôts et....

The central banks of Switzerland and France are joining hands with the Bank for International Settlements to test wholesale central bank digital currencies in cross-border transactions. The experiment will be conducted with the help of a private sector consortium led by Accenture. European Central Banks to Collaborate on CBDC Project The Swiss National Bank (SNB), Banque de France, and the Bank for International Settlements (BIS) Innovation Hub have announced this week they’ll cooperate on trials exploring the use of wholesale central bank digital currencies (CBDCs) for cross-border....

Led by Belgian financial services firm Euroclear, the latest French CBDC trial involved a system by tech giant IBM. The central bank of France continues actively exploring a central bank digital currency (CBDC), completing a significant trial of a blockchain-based CBDC in the country’s debt market.Over 500 institutions in France have participated in a 10-month experiment testing a CBDC issued by Banque de France for government bond deals, The Financial Times reported Oct. 19.The CBDC trial was led by Belgium-based financial services firm Euroclear and used a system developed by American....

As the adoption of digital assets is becoming more mainstream, some countries are awakening to join the flow. This has borne the desire to get a central bank digital currency, CBDC, by some countries. One of such countries is France. For some months, the Central Bank of France has explored a central bank digital currency (CBDC). Recently, the apex bank is rounding off a remarkable trial of a CBDC based on blockchain within the country’s debt market. According to the reports, there has been a 10-month testing experiment for a central bank digital currency in the country. Banque de France....

The central bank digital currency project will test cross-border settlement between French and Swiss fiat currencies. The Bank of France and the Swiss National Bank are teaming up with the Bank for International Settlements’ Innovation Hub to test a wholesale central bank digital currency (CBDC) system dubbed “Project Jura.”According to a release by the Bank of France on Thursday, the Project Jura pilot study will also draw participation from a private consortium led by global service company Accenture. Other establishments in the private consortium include Credit Suisse, UBS, SIX Digital....