ICO, Explained

1. What is an ICO? An ICO is a recently emerged concept of crowdfunding projects in the cryptocurrency and Blockchain industries. ICO stands for Initial Coin Offering. It’s an event, sometimes referred to as ‘crowdsale’, when a company releases its own cryptocurrency with a purpose of funding. It usually releases a certain number of crypto-tokens and then sells those tokens to its intended audience, most commonly in exchange for Bitcoins, but it can be fiat money as well. As a result, the company gets the capital to fund the product development and the audience members get their crypto....

Related News

The Van Wirdum Sjorsnado has rebranded, and is now called Bitcoin, Explained!

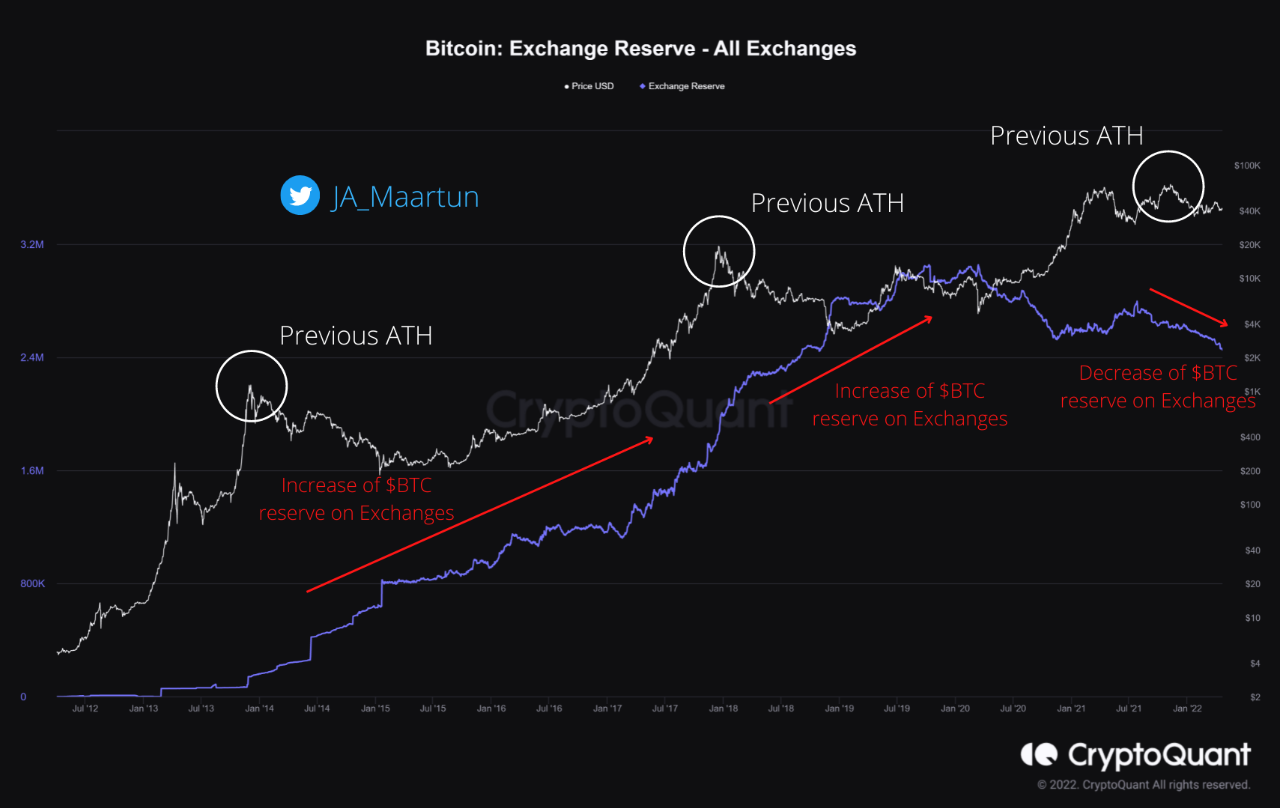

A quant has explained using on-chain data why the current Bitcoin bear market looks to be different from the previous ones. Quant Suggests This Bitcoin Bear Market Is Unlike The Rest As explained by an analyst in a CryptoQuant post, the exchange reserve continuing to trend down since the price all-time high isn’t typical of […]

BTCC, one of the largest bitcoin exchanges in the world, announced its Pro Exchange at a Money 20/20 panel held at The Venetian Resort Hotel Casino in Las Vegas. Pro Exchange is a bitcoin margin trading tool that will allow traders to exercise 20x leverage on spot trading. Unlike BTCC's regular spot exchange, which might be useful for those who are looking to buy or sell one or two bitcoin, Bobby Lee, CEO of BTCC, explained that this product is better suited for more experienced traders. "If you want to buy a lot of bitcoin, it's a quick way to get a lot really fast," Lee explained in an....

A quant has explained how the Bitcoin exchange reserve on-chain indicator differs between the current crash and that of May’s. After Spiking Ahead Of The Crash, Bitcoin Exchange Reserves Have Resumed Downtrend As explained by an analyst in a CryptoQuant post, the current trend in BTC exchange reserves is quite different from when the crypto […]

On September 5, Binance explained that it planned to drop a number of usdc trading pairs and auto-convert specific stablecoin balances into busd by September 29. While the move was controversial among crypto proponents on social media, Circle Financial CEO Jeremy Allaire explained that the change “will likely lead to more usdc flowing to Binance.” Circle’s Jeremy Allaire Thinks Binance’s Forced Stablecoin Conversions Will Likely Lead to More USDC Flowing to the Exchange Circle’s CEO Jeremy Allaire spoke about Binance’s recent move to....