Median DeFi token return on par with Bitcoin this year

Analysis of 38 top DeFi assets reveals a median performance only 15% above Bitcoin. Despite a pull back from the meteoric bull market for decentralized finance, the average DeFi token return has vastly outperformed Bitcoin and Ethereum. The median performance is a different story however.On Nov. 17, pseudonymous crypto analyst ‘Ceteris Paribus’ shared data with his 12,000 followers compiling the YTD median and average performances of 40 top crypto assets, comprised of 38 top DeFi assets, Bitcoin (BTC) and Ether (ETH). Around 26 of the DeFi assets are currently posting YTD gains.The analyst....

Related News

A report by Steno Research states that the decentralized finance (DeFi) summer on Ethereum and the crypto market could return as early as 2025. Four years after the fondly remembered DeFi summer of 2020, the total value locked (TVL) in protocols can hit an all-time high by early next year. However, the return of DeFi […]

September 6, 2021: FXT – a company witnessing the remarkable success of its FXT Token – is geared to launch a DeFi staking platform. The platform will be built on Binance Smart Chain and will enable crypto enthusiasts across the globe to stake their BEP-20 FXT tokens in return for lucrative interest that will be […]

An analyst has explained how the worst could be behind for Bitcoin, and Q4 may bring back bullish momentum if history is anything to go by. Q3 Has Historically Been The Worst Time For Bitcoin Investors In a new post on X, Capriole Investments founder Charles Edwards talked about how investors are going through the worst time for Bitcoin. Below is the table cited by the analyst, which breaks down the quarterly returns the cryptocurrency has seen throughout its history. As is visible, the third quarter of the year has generally been the worst time for Bitcoin throughout history, with average....

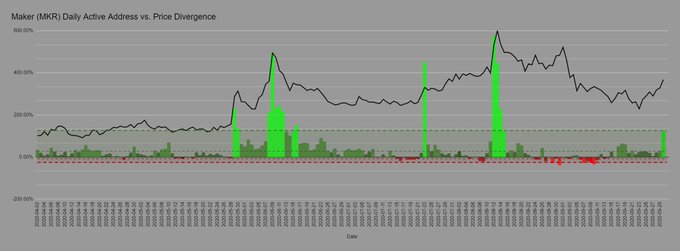

While decentralized finance (DeFi) has seen a strong surge in 2020, Maker (MKR), a token strongly tied to DeFi, has underperformed. The cryptocurrency, relative to its competitors, is underperforming; where Aave’s LEND and Synthetix’s Synthetix Network Token surged hundreds of percent in this year alone, MKR only saw a 20-30% move higher. The market may […]

While a number of digital currencies have seen price gains the two leading crypto assets, bitcoin and ethereum have seen transaction fees skyrocket. For instance, data shows that the median fee for a bitcoin transaction is $8.58, while the median fee is $9.35 when spending ether. Meanwhile, the average transaction fee for both networks has been much higher between $14 to over $20 per transfer. During the course of 2021, crypto assets have increased a great deal in value but alongside this, the fees to transact on these networks have risen as well. Bitcoin (BTC) and Ethereum (ETH) are the....